Here are some things I think I am thinking about:

1) Moar Home Owners? There was a funny (and serious) Tweet going around in recent days.

This made me laugh.¹ Homeownership is massively overrated. I used to rent. I miss it all the time. Don’t get me wrong. I love my house. I bought this old beat up house near the beach and I basically drove a bulldozer through it (which was amazing) and then I spent much of the last 3 years building it myself. It’s been fun, educational and truly horrible at times (boy do I have some stories for you…). But the bottom line coming away from my experience as a home owner is that it’s massively more expensive (in many ways) than most people realize. Aside from the mortgage cost and the property taxes you’re constantly paying the maintenance expense ratio. It’s like an asset that generates 5-10% annual returns, but then costs you 3-5% in fees every year. It’s like the worst version of a super high fee mutual fund that you could possibly imagine.

As for renters getting in on the equity upside? I don’t know if they really want such a thing. After all, that would mean having exposure to those property taxes, mortgage costs, maintenance costs, and any potential downside price changes. Don’t get me wrong. I love owning and the subjective benefits for me are tremendous. But there’s a lot to love about renting because the subjective nature of the related responsibilities (or lack thereof) is a huge benefit.

2) Moar Inflation? I’m on record saying that I am more concerned about inflation this time around than I was in 2009 when I was somewhat famously a lowflationist.² There’s a bunch of reasons for this view that I will get into in a more detailed post later on, but this morning’s CPI report is starting to justify some of those concerns. But I don’t want people to panic and start thinking that Cullen the Lowflationist is now turning into a Hyperinflationist. No, no, no. My forecast for core inflation is 3-4% by 2022. So, well above the Fed’s target and probably enough to get them panicked a little, but nothing close to what the Hyperinflationists believe.

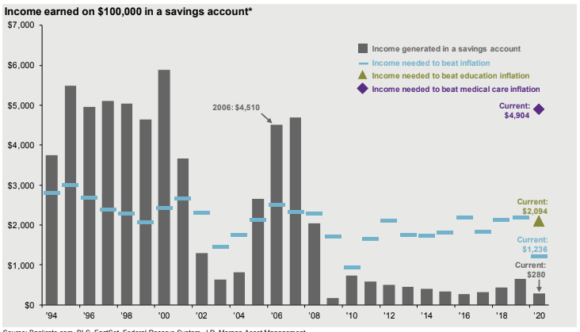

3) Moar Income? It sucks to be an income investor these days. And it’s going to get even worse if inflation rises. Here’s a chart from JP Morgan depicting this:

You basically need to step out on the risk curve and start taking some stock market like risk or longer duration bond risk if you want some income. The worst part is, if inflation ticks higher the Fed has made it clear they won’t raise rates any time soon. So you could get a form of yield curve control here where inflation is rising, demand for government debt is declining and the Fed insists on keeping rates low. Navigating the future of the bond market has probably never been harder than it is today. And don’t even get me started on stocks. With the recent explosion upward there’s a strong argument to be made that investing has never been more difficult than it is right now.

¹ – If you take this sort of insane thinking to its logical extreme then we would basically own part of everything we consume. Oh, you ate a sandwich the other day? You should get part of the ownership of the sandwich company! Oh, you drank 20 beers at the local bar last week? Why don’t we give you an equity stake in the bar? But I guess this is a sign of the times and the extreme sort of politics we’re increasingly seeing on both sides.

² – I’m really playing fast and loose with the word “famous” here. What I really mean is that there are about 100 people in the whole world who follow my work close enough to know that I predicted low inflation back then.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.