Here are some things I think I am thinking about:

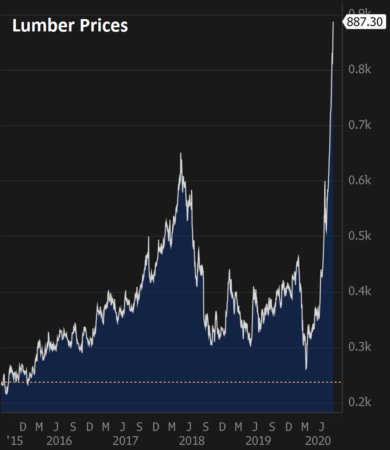

1) Holy lumber, batman! Have you checked out lumber prices lately? Prices have TRIPLED since the March bottom. It’s one of the most interesting economic developments since the pandemic started. Basically, people started staying home and realizing they wanted to remodel the house. Other people started moving out of big cities driving demand for new construction. Young home buyers tried to pounce on the economic weakness. Lumber mills got shutdown due to the pandemic. And the government printed a few trillion dollars and bolstered disposable income. And here we are.

It’s hard to say how this is going to filter into the economy in the coming months. I remodeled our house over the last 2 years and we placed a $60,000 lumber order in 2019. Out of curiosity I looked up the retail price of a generic whitewood 2X4 at Home Depot and the price has increased 50% since I purchased some in March, 2020. I would imagine that a lot of this surge in price is going to continue flowing into the end product as the year goes on. I can’t imagine I’d have done as much work on the house if my lumber bid had come in at $120K or $180K. So I have to imagine that this is going to start causing some bumps in the construction industry in the coming years. As they say, the cure for high prices is…high prices.

As for inflation, this is obviously an extreme case, but as I’ve been noting, it’s likely that inflation is going to be jumping back above the Fed’s target in the coming years as aggregate demand has remained very robust and supply chains remain disrupted. Don’t be surprised if the Fed is backpedaling on some of its policies as we roll into late 2021 and 2022 and the recovery is very obviously full steam ahead.

2) COVID, lumbering along. Back in March and April I wrote some fairly optimistic pieces on the pandemic and the likely outcomes. I said that the most probable scenario was that this would look nothing like a Great Depression and that the virus would largely subside by Summer and that the stock market had likely bottomed already. This is all looking more and more accurate. Yes, the economy is likely to remain somewhat weak for years to come. That’s typical when you lose as many jobs as we lost earlier in the year. But the key thing to understand about this economic environment is that the pandemic was an exogenous shock, not a structural downturn. It was more like a natural disaster than a real economic recession. And as the likelihood of a vaccine, better testing and better treatments become clear the economy is quickly returning back to some semblance of normalcy.

My guess is that COVID will lumber along into 2021. It’s still too early to celebrate. But there’s a lot of good news out there and we’re very likely to have readily accessible and fast testing before the end of the year. And we’re likely to have multiple vaccines in 2021. So, it could be a long Winter, but there’s a lot to look forward to as we move into 2021.

3) Will the stock market lumber along? In my April research note I said:

The long-term equity market participant should be licking their lips at this environment as other investors adjust their portfolios for their temporal/behavioral mismatch. I calculate future expected 10 year equity returns at 7%, up from 4% just a few months ago.

Well, I just updated that figure and…we’re exactly back to 4% expected returns. As James Montier recently noted in his excellent piece at GMO, there are many reasons NOT to be so cheery when it comes to stock market valuations. Yes, the market has correctly rebounded from what many incorrectly thought was going to be another Great Depression. But the strange thing about this exogenous shock is that it puts us essentially back on track for where we were pre-crisis. In other words, valuations are high, expectations are likely too high and so the prospects of future stock returns begin to look increasingly bleak…

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.