Hope your long weekend is going well. Here are some things I think I am thinking about:

1) Has inflation finally peaked?

I am ready to call it. Inflation has peaked or will peak in the coming few quarters.

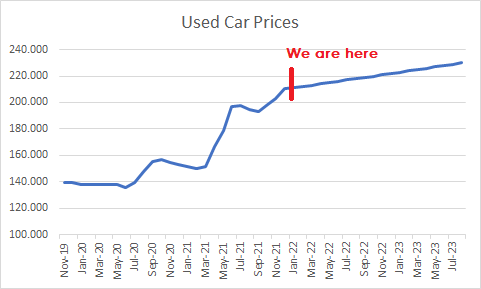

I’ve discussed the broader picture in the past (see this big piece for details), but the biggie here is an increasingly impactful statistical topping effect that is going to start putting downward pressure on the data in the coming quarters. Used cars are a great example of what’s been happening here and why the big rise in prices bodes well for future rates of inflation. Here is the current state of used car prices in the CPI:

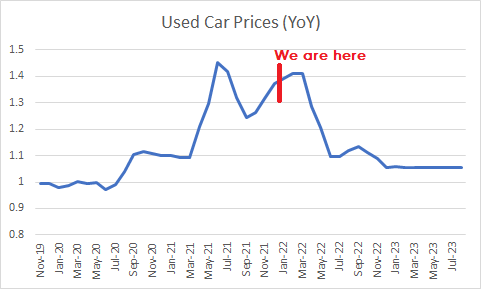

I stretched the data out assuming a 5% increase in annual prices into 2023. The rate of change is already slowing and 5% is a high average rate relative to the historical average of 3.2%. And here’s how this looks in the year over year data moving forward:

In short, we’re on the verge of a pretty significant decline in the year over year data.

Of course, this doesn’t mean we’re going to see low inflation or anything close to the Fed’s target this year, but the odds of a runaway style hyperinflation look increasingly low outside of a scenario where these huge price gains continue to run at the same rate of change.

It’s worth adding that this is already starting to slow in broad commodity prices which have been flat for 3 months. The rate of change is also slowing across the majority of the CPI so it looks to me like the COVID fiscal stimulus caused a huge one time bump in prices that is now beginning to slow materially.

Then again, we might be in this escape velocity sort of price spiral and I will end up looking like a total moron here. And although I am highly biased, I am betting against me being a moron.

2) Krugman and banking (again).

Here’s a strange piece from Paul Krugman in which he says:

“Since the 2008 financial crisis, however, banks have been voluntarily holding vast excess reserves, apparently because they don’t see enough good lending opportunities – and the Fed has been paying interest on these reserves, which makes them more like government debt than money the private sector was forced to accept.”

Oh boy.

For those who didn’t read my work back when, Krugman and I had a big back and forth on this in 2013. Basically, Dr. K was consistently regurgitating money multiplier concepts about why QE wasn’t causing inflation. And I was responding saying the money multiplier was bunk. Here’s the short and sweet summary:

- The Fed determines the quantity of reserves held by the banking system. There is nothing the banks can do to offset this if the Fed wants to set a quantity as they are the monopoly supplier of reserves and the banking system is a forced user of the reserve system.

- The quantity of reserves held by the banking system does not meaningfully impact loan issuance. In fact, in most cases, banks make loans and find reserves after the fact. If there are not enough reserves in the system for the banks to meet their reserve requirements then the Central Bank must issue them.

- More reserves does not mean more lending capacity for bank. This is why QE did not and cannot cause hyperinflation.

- Interest on reserves is not making banks hold reserves. The Fed is setting the quantity of reserves. The reserve system is a closed system. Banks can lend reserves to other banks, but they cannot lend them to non-banks and as the reserve monopolist in a closed system the Fed effectively forces banks to hold reserves whether they pay interest or not.

This made for some interesting debates over the years, but the Fed has since admitted that the money multiplier is a myth. There are all sorts of tangential debates about “liquidity traps” and stuff like that, but I won’t give you brain damage reading about that stuff.

Anyhow, I’ve beat this horse pretty good over the years, but apparently I am not hitting it hard enough. This is a real shame because I love horses and would rank them in my top 3 animals of all-time.

3) Some Other Weekend Reading. A few items that are worth a read:

- Quantitative Tightening, A Primer. This is a great step-by-step walk-through of the accounting of QT. Joseph Wang is a former Fed employee and a great follow on Twitter.

- Is the Fed responsible for an 800% gain in stocks? By Ben Carlson. Ben is great as always. And he confirms my priors here so, perfect.

- Living through a crash. By Barry Ritholtz. This is a great reminder of what a bear market is really like. The time to prepare for the bust is during a boom.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.