Here are some things I think I am thinking about:

1) Grantham calls for a market crash.

Here’s a provocative piece from Jeremy Grantham saying we’re in the 4th “superbubble” of the last century. I won’t ruin the uplifting read for you, but I will just say this – I don’t love making these sorts of huge extremist calls because this sort of emotionally charged rhetoric tends to lead people to make extreme portfolio moves. If you think a crash is around the corner then you move to 100% cash. And then what? What’s your plan to get back in? Do you get back in? What if the market keeps grinding higher? That’s the problem with taking these maximalist positions in things. You end up with hyper-emotional reactions to the way the markets change over time.

Then again, what if Grantham is right? This is why we diversify. We diversify our savings specifically because we don’t know what’s going to happen in the short-term and we want to insulate ourselves from behavioral biases. So we accept the reality that some part of our portfolio is likely always going to perform poorly while other parts perform better. You don’t have to care so much about extremist predictions because a diversified portfolio makes you more behaviorally robust than the portfolio where you’re exposed to asymmetric outcomes from outlier events.

2) Bonds don’t diversify anymore?

There’s been a lot of chatter in recent weeks about how bonds no longer diversify a portfolio because bond prices have been falling with stock prices. This is hyper short-termism at work here. Let me explain using a simple example.

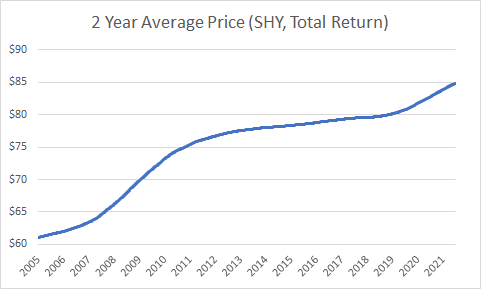

SHY is a constant maturity short-term bond ETF with an average maturity of 2 years. So the way to think of this portfolio is that its average holding has matured so long as you hold the fund for 2 years. Below is the rolling 2 year returns in this fund. You’ll notice that there are zero negative two year return periods because the average holding matures over the course of two years. In other words, if you treat a constant maturity bond fund like an individual bond then you need to hold that fund for its average maturity to benefit from the actual underlying maturation periods accruing to the net asset value of the fund:

Looking at this more recently, SHY is down 1.1% since September which makes it look like it’s not diversifying the portfolio. However, if the stock market falls 50% in the next two years from the September 2021 levels, you can be virtually certain that SHY will be slightly up over the same period. It will significantly buffer your portfolio regardless of what happens in the short-term primarily because bonds, in terms of bear markets and volatility, are totally different beasts compared to stocks.

This is why I am an advocate of asset liability matching strategies. When you specifically bucket your time horizons in your portfolio you don’t fall into this trap of thinking about the super short-term because you know that your SHY allocation shouldn’t be judged inside of a 2 month period when its underlying components are specifically designed to operate across 2 year periods.

I have a whole section about Understanding Bonds if you want to learn more.

3) Home bias is worse than we think?

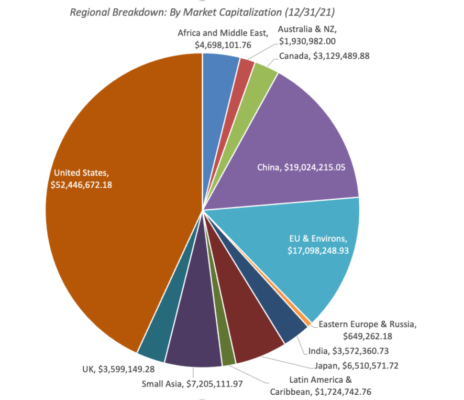

Aswath Damodaran had a good Q1 data dump. Aswath does one of the most comprehensive looks into global corporations that I’ve ever seen. And one of the most interesting aspects of his data is that he confirms something I’ve talked about in the past – the US market is much smaller than most people assume. Many public ETFs like Vanguard Total World and MSCI All World show the USA at 60% of total market cap because they’re using a free float methodology. If you use full cap methodology like I do then you get closer to 40% USA market cap. A full 20% difference.

Anyhow, Aswath is great in case you don’t follow his work. Go poke through his data dump. Lots of good stuff there.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.