My general view on foreign exchange is that no one can really predict the short-term movements of currencies.¹ They are zero sum games with fairly high frictions with so many moving parts that they’re virtually impossible to predict. So trading foreign exchange is usually a bad decision. There’s one exception to this – foreign travel. And when it comes to foreign travel I don’t just rely on trading foreign exchange rates I do it almost exclusively.

In my heart I am a value investor. As most of us probably are. After all, there aren’t many of us who say “I love feeling like I just got ripped off!” And the thing is, “trading” foreign exchange rates is pretty easy if you’re a traveller. You just have to be patient because, given the zero sum nature of the game, there’s always a bargain somewhere and in the world of foreign exchange the discounts you’ll find thanks to currency gyrations create amazing bargains.

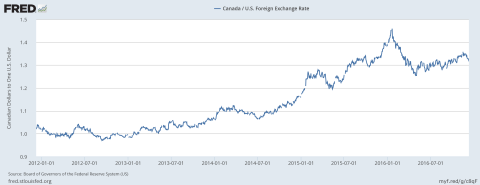

The best bargains for Americans, luckily, are right next door. If you’re a value investor and a skier then Canada has become a total no-brainer. Better mountains, nicer people, a currency that’s almost 30% cheaper than it was just a few years ago. What’s not to love?

(Click for Bigly Version)

But you don’t like cold weather and skiing you say. That’s okay. I’ve got you covered. The recent election sent the Mexican Peso into a tailspin. The Peso is almost 50% cheaper than it was just a few years ago. That’s what some people might call a “bigly” decline.

(Click for Bigly Version)

So, there you have it. Close, quality vacations and on sale. And heck, you and I both know that the USA is going to be fairly intolerable until the current news cycle slows down and people come to grips with President Trump. So getting out of the country for foreign vacations is not just a good financial decision, but probably good for our sanity as well.

¹ – The one exception to this rule is Central Banks who can predict the short-term movements of their currencies by setting its price only to discover in the long-term that they don’t control the fundamental drivers of the economy (which eventually force these price setters off their pegs).

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.