If you take a basic finance course the first thing you learn about bonds is that bond prices are inversely correlated to interest rates. So, when rates rise bonds prices fall and vice versa. This idea is so ingrained into people’s heads that it seems to have become the only thing that anyone can remember about bonds. And in today’s low interest rate environment this thinking is usually applied as follows:

- Bond prices will fall if interest rates rise.

- Interest rates are near 0% so they can’t go much lower which means they might go up a lot.

- If interest rates go up a lot I will get taken out back and beaten like a red headed stepchild.¹

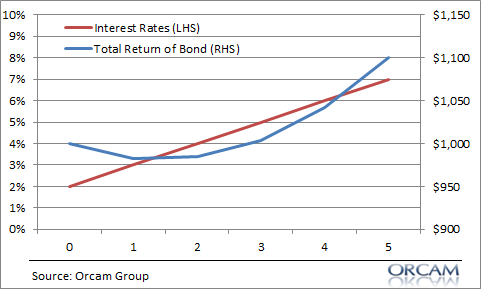

There’s only one problem with this thinking – it’s not necessarily right! The correct statement is, if interest rates rise then bonds prices fall in the short-term. Take, for instance, the case of a 5 year bond with a face value of $1,000 paying 2% per year. If interest rates rise by 1% every year that bond still pays you 2% every year plus you get your principal upon maturity.² Here’s how the total return of that bond looks over the course of your 5 years:

If you held on for 5 years you didn’t lose money despite the fact that interest rates rose. This is slightly more complex in the case of a bond fund which is essentially a constant maturity bond, but the same general principles apply. If you missed my recent discussion on that you can read it here.

Importantly though, had you sold the bond in any period prior to year 4 then you did take a capital loss. And this brings us to the primary problem with bond investing and asset allocation in general – most people don’t apply the right maturity and/or duration to their portfolios. Most of us suffer from a horrid case of short-termism. As I like to say, asset allocation is all about asset and liability mismatch. We have short-term cash flow liabilities that we try to match to longer-term assets. Most people want high returns today from instruments that are not designed to provide us with immediate returns. This results in a misuse of the instrument as a bond (and even a stock to some degree) is designed to pay you a certain amount over certain periods of time. If you’re not prepared to potentially hold the instrument for most or all of its maturity then your risk of permanent loss increases substantially.

The key lesson here is simple – don’t let the low rates of today scare you into thinking that you shouldn’t hold bonds. You simply need to understand the product you’re buying and how its maturity and duration relate to your time horizon. And while you might lose money in real terms if rates rise your probability of losing money in nominal terms is fairly low. In either case (rising rates or continued low rates), buying the appropriate bonds in a diversified portfolio is still a perfectly suitable approach for the investor who constructs their portfolio properly and within the scope of their risk profile.

¹ – I do not provide investment advice or child rearing advice on this website. Though I do have a red headed younger brother who, on occasion, deserves to be beaten.

² – Investors these days are deathly afraid of a rising rate environment. I think this is overblown. Holding long-term bonds in a rising rate environment is only scary if you have no intention of holding them for a long time. The far scarier environment for most people is the one where rates stay very low because economic growth remains weak. In this case bonds won’t hedge stocks all that well and investors with a low risk tolerance will struggle to generate sufficient returns.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.