I wrote a controversial article a few months back about how I like to think of stocks as bonds. This wasn’t meant to be taken literally – I mean, I know that stocks and bonds are not the same thing and that their fundamental contractual obligations make them very different. I wrote a book about this stuff after all! But while they’re different in many ways they are also similar in many ways:

- Stocks and bonds are different forms of securities that achieve the same basic thing by helping companies raise capital.

- Stocks and bonds are both contra-assets for a companies which, for practical purposes, makes them corporate liabilities.

- As Warren Buffett has noted many times, stocks actually look a lot like bonds because they have a fairly fixed “coupon” even though their duration is unknown. However, as I performed in my recent paper on portfolio construction, you can overcome this using various heuristic techniques.

In my view, the stock market is like a super long duration high yield bond. If you hold that instrument for several decades you have a high probability of earning a high single digit return on average. But the reason that it can be useful to think of stocks like bonds is that it helps you put the returns into a better perspective. Since we know the exact time horizon for certain bonds and we also know their exact yields it can help us manage the risk of those instruments more clearly than the risks within equities. After all, while we can think of equities as multi-decade instruments they are really perpetual instruments whose time horizon is unknown. This is what makes the stock market so difficult to predict. Its effective duration is super duper long. Bonds, however, have a specific time horizon over which they generate their cash flows.

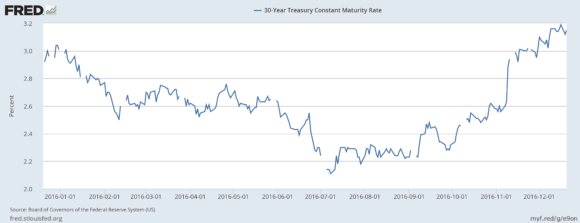

Anyhow, I use a duration tilting strategy inside of my countercyclical strategies to generate a simple rebalancing tool that manages interest rate risk. You’ve probably seen me discuss some of the big changes over time including the big blow off in 2009 (when I said long bonds were going to be risky in 2009 before they cratered 20%) or more recently like last summer when I said long bonds were experiencing a major “price compression”. In simple terms, what we’re doing is analyzing the risk adjusted potential future returns of the instrument. So, when a 2% yielding 10 year bond suddenly generates 20% returns in a 6 month period then you know, with a high degree of chance that that instrument has become riskier because it just paid out 10 years worth of coupons in principal changes. Yeah, it’s more complex than that, but not by too much.

Back to the present though – what’s happening now in bonds is kind of the opposite of what we saw last summer. I recently mentioned on Twitter how the bond market was going through a bit of a “Trumper Tantrum”. Following Trumps’ win we’ve had this huge surge in rates based on the idea that Trump might create inflation and higher growth. So bonds are adjusting for this. But these kinds of big moves in rates can create the potential for disequilibrium where the market is pricing in more in the near-term than the long-term is likely to give us. So while the bond market was excessively bearish last summer the price compression has now largely unwound and we’re finding ourselves in a more normalized bond market environment where some duration risk is a much better risk adjusted allocation. And so the question we have to ask ourselves is whether the bond market is pricing in more than what Trump can deliver? I suspect yes. And that means long bonds and duration risk is much more attractive now than it was earlier in the Summer.

If you’d like to learn more about our Countercyclical Indexing strategy please see here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.