I joined Oliver Renick on TD Ameritrade Network last Friday to discuss the housing market and some of my recent comments from the newest Three Minute Macro video. In short:

- Interest rates over 6% creates an unaffordability problem that is likely to put downward pressure on prices as demand dries up and supply increases.

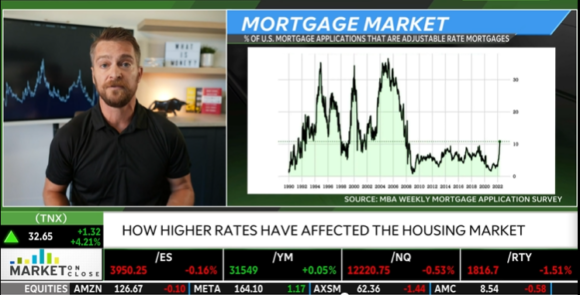

- This isn’t a 2008 repeat, however, because you won’t have the low quality adjustable rate borrower being forced to panic sell.

- We’re also unlikely to see a financial panic because banks are much healthier and the Fed is much more involved in shoring up the financial markets at the first whiff of contagion.

- Housing is likely to be fragile for several years until the supply/demand imbalance in the interest rate market corrects.

- My estimate is that prices could fall 10-15% at the national level and perhaps more in hotter markets.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.