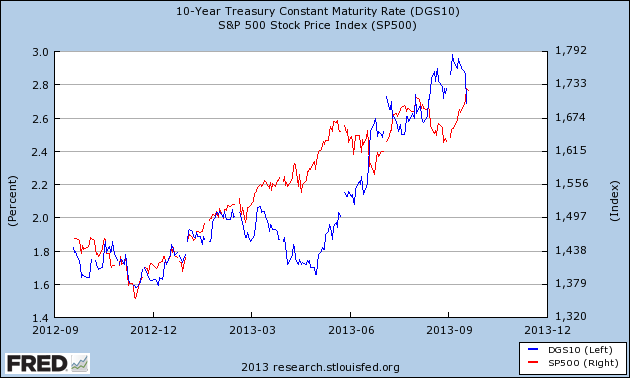

You can’t go a day reading financial market news without hearing about the Fed and the “taper”. The story is generally pretty simple – the Fed is helping to steer stock prices via QE. And that idea is generally supported by vague charts showing a correlation between the Fed’s balance sheet and the S&P 500. More recently, this became a story about how the Fed caused a bond market panic. But earlier this year when discussions about the “taper” began, we started to see markets react oddly. The bond market sold off as the year progressed and the stock market just continued to shoot higher. This doesn’t mesh with the conspiracy theories about the Fed and stock prices. After all, if the rise in bond yields were due entirely to the “taper” then wouldn’t the same negative behavioral dynamics be impacting stock prices to some degree? But we haven’t seen any impact of the “taper” on equities. In fact, equities just continued to surge higher through all this discussion of the taper.

So what is the explanation? How come bond yields have risen while stock prices have risen? Well, in my opinion, this is just another case of the fear trade losing out. The market is really an expectations game. If most people expect the economy and stock market to perform mediocre and it does slightly better than mediocre then you get a year like 2013 where stocks melt higher as things look better than expected. The rise in yields is also completely in-line with this thinking. That is, bond traders who expected yields of 1.6% to sustain themselves in an environment with 2% inflation have been wrong.

I think some people have a tendency to try too hard to attach every little move in the market to some specific policy. And the Fed and the “taper” is always an easy explanation that makes sense. But when you look at the performance of stocks and bonds in 2013 this story starts to look a lot less convincing.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.