John Bogle made headlines a few weeks back when he declared that a US investor shouldn’t have any foreign exposure. He was making a fairly active allocation decision here by saying that an investor should maintain a strict home bias. I said this wasn’t consistent with the idea of a “passive” portfolio selection and actually exhibited a strong bias and active deviation from global market cap weighting. Several other people agreed with me.

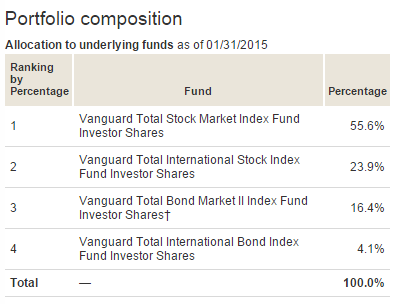

What’s interesting, however, is that Vanguard seems to agree with me. In an announcement last week they said they were increasing their foreign stock and bond exposure in many of their LifeStrategy and Target Retirement Funds. For instance, in their LifeStrategy Growth fund they will be boosting the foreign equity component from 30% of equity exposure to 40%. So, instead of a 24% weighting you’ll now have a 32% weighting.

I don’t care so much that Vanguard makes active changes in their portfolios as long as it isn’t having adverse tax and fee consequences. But who is the committee that makes these active decisions and what is the rationale? Here’s what Vanguard says:

“International holdings are a valuable diversifier in a balanced portfolio, giving shareholders exposure to return streams that don’t move in lockstep with the US markets. It has become easier to capture these diversification benefits as the costs of international investing have decreased,” said Vanguard Chief Investment Officer Tim Buckley. “We carefully debate the merits of proposed changes to our Target Retirement Funds and other funds-of-funds, and make them when deemed to be in the best, long-term interests of our clients.”

That seems pretty reasonable. So, costs will remain the same and the portfolios will better reflect the global nature of our financial markets. That’s certainly much more in keeping with the idea of a “passive” portfolio as I’ve described the one true passive portfolio, the Global Financial Asset Portfolio. And as long as you understand that this is a fund that is actively deviating from global cap weighting (this is a 80/20 stock/bond fund vs global cap weighting of 45/55) and is maintaining a very low expense ratio then the whole “active” vs “passive” debate doesn’t matter as much as some people make it seem. That is, this debate is not so much about active vs passive, but really about understanding how a portfolio is constructed, how your asset allocation will drive its performance, what the risks are and what the expenses are.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.