The dirtiest trend on Wall Street these days isn’t hedge funds or ponzi schemes. It’s high fee “passive indexers” who are passing themselves off as something different from “active managers”. I’ve already shown on several occasions how we are all “active” investors to begin with so this whole discussion gets confused before it begins (see here for the details), but you should understand how the rise in the popularity of “passive” indexers is now being used to trick you into similarly high fee approaches as the “active” approaches that “passive” indexers often disparage.

Here’s what’s happened over the course of the last 10 years as “active” stock pickers have come under fire for underperformance – asset managers are selling the same fee structure with a different story. It used to be that you could run a c-share mutual fund and charge investors 1-1.5% recurring. But that story has come under increasing fire as it’s been shown that many stock picking mutual funds are just high fee versions of an index fund. For instance, in my book I highlighted how one of the largest mutual funds in the world was no better than an index, but charged a substantially higher fee per year. This fund, one of the most recognizable funds in the world charges about 0.7% more than the least expensive S&P 500 ETF, but tracks its performance almost perfectly. We’re talking about $1 billion in wealth extraction every year due to the sheer misunderstanding of the shareholders who choose to own this fund without knowing that there is a similar and less expensive option.

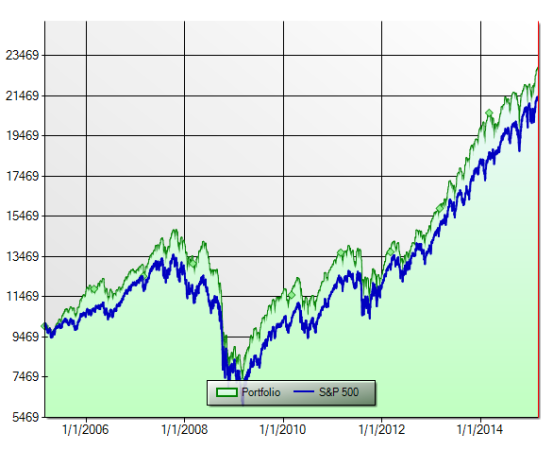

(One of the biggest mutual funds, and rip-offs, in the world)

Sadly, this is true across most of the mutual fund space. If you benchmark the fund correctly you can almost always find an index that replicates 90%+ of the performance without the high fees. If this is “efficient” markets at work then we must all be a bunch of dopes because there’s trillions of dollars in retirement plans and taxable accounts allocated by investors who probably don’t know any better….

But Wall Street has changed its pitch since then. Today, more and more advisors have moved to the RIA or Robo Advisor structure where they can recommend low fee funds like Vanguard. But here’s the nasty part – they’re charging you the same high fee and calling themselves “passive” just because they use index funds. For instance, DFA is one of the largest low fee index fund providers in the world. They manage over $400 BILLION, but the kicker with DFA is that you need to work with a DFA approved advisor to own their funds. The average RIA charges 1% per year just for asset management services which means that once you add on the DFA fund fees which generally range from 0.1%-0.55% you are actually paying the same load as a c-share mutual fund for owning an index fund! You are in the same exact high fee relationship you were before except it’s been marketed to you with a different sales pitch.

Now, some people certainly need an advisor. Plenty of studies have shown that most retail investors actually do worse when they don’t have an advisor primarily because the advisor helps to keep them from making big mistakes and being overly active (see here and here). Staying disciplined in a highly emotional monetary world is no easy task. And as I’ve noted, intelligently picking your actual asset allocation will actually be the most important part of the whole process. But beware of this trend on Wall Street. Buying a “passive” approach with an “active” fee structure doesn’t mean you’re necessarily going to do any better. It just means you bought into Wall Street’s latest fancy sounding sales pitch.

- The Myth of Passive Investing

- The Allocation Matters Most Hypothesis

- Understanding Your Real, Real Returns, Fee Edition

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.