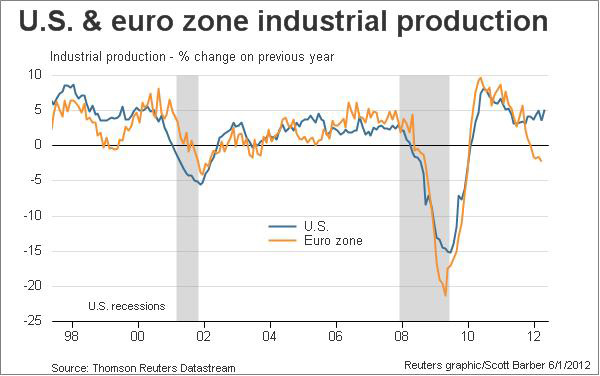

Last year I made a very unpopular call that the US economy was likely to remain in positive growth territory as Europe sank into recession. In an increasingly interconnected world this idea of decoupling doesn’t always make a lot of sense to most people. But the policy response in Europe and the USA has been so dramatically different that the signs of this decoupling become increasingly obvious. The latest industrial production data via Reuters really highlights this point:

“Historically, it has been the pattern for economic weakness and recessions in the United States to trigger economic woes among its trading partners globally; as this chart shows, the U.S. is always just slightly ahead of Europe when it comes to an economic downturn. Now the question becomes whether this pattern will reverse itself: the fear that Europe’s economic woes will come home to roost in the United States sparked what some pundits have dubbed over-reactions in both bond and stock markets during May. True, some economic data has come in slightly weaker than expected, but there are no clear indicators that growth is poised to evaporate. Still, the anxiety is that Europe’s woes are so severe that it is impossible for them not to spread.”

The big difference between Europe and the USA has long been the difference in budget deficits. Many of the European countries are suffering through extreme austerity while the USA continues to spend. This is helping to bolster the economy as we suffer through historically low levels of private investment due to the balance sheet recession. But in Europe it is like trying to swim with a weight tied to your foot. I don’t see any reason why this decoupling trend should end now given there has been no substantive change in policy….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.