Here are some things I think I am thinking about.

1) 60/40 Stocks/Bonds – Where did this idea come from?

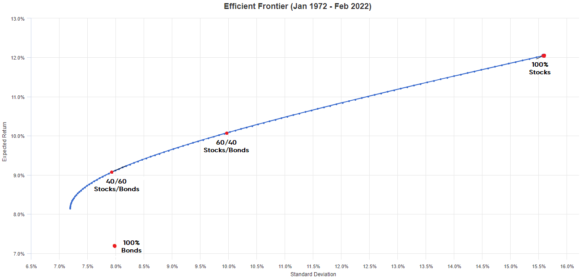

Here’s Corey Hoffstein on Twitter asking where did the 60/40 portfolio come from? It’s an interesting question – after all, the 60/40 has become the gold standard of portfolios so you’d think that there’s very strong empirical support for this specific allocation. Except there isn’t really. In fact, when we look at the historical data the exact opposite portfolio (a 40/60) has been the optimal risk adjusted return portfolio.

This isn’t just an empirically supported fact – it makes sense from a basic efficient market understanding as well since the Global Financial Asset Portfolio is approximately 45/55. So it makes perfect sense that a portfolio that’s relatively close to this is the more efficient portfolio.

This isn’t just an empirically supported fact – it makes sense from a basic efficient market understanding as well since the Global Financial Asset Portfolio is approximately 45/55. So it makes perfect sense that a portfolio that’s relatively close to this is the more efficient portfolio.

But I’ll take Corey’s question even further though. It’s worth asking why 60/40 is the right portfolio, but it’s even more interesting to ask why you’d maintain a 60/40 in perpetuity? In other words, you rebalance back to 60/40 because the 60% slice is procyclical and will grow into more and more of the portfolio over time if you allow it. You have to rebalance or you become more and more exposed to downside risk in stocks. So rebalancing is a form of what I call Countercyclical Indexing because it reduces the procyclical aspect of the stocks in the portfolio. The problem is that the risks in the 60% slice are hugely procyclical. So I’ve argued that countercyclically rebalancing a 60/40 back to 60/40 isn’t even enough in many cases because it can create the risk of very significant drawdowns at times because the 60% slice becomes so risky at times (think 1999, 2008 or 2020).

Anyhow, the responses to Corey’s question are pretty interesting mainly because no one really seems to know where 60/40 came from other than the fact that it seems to be a popular way to get stock exposure without getting too much stock exposure.

2) Solving inflation with more spending – where did this idea come from?

There was a viral video on Twitter where Gavin Newsom, the Governor of California says he’s going to send money to drivers to help them deal with the high inflation/gas problem. What? You’re going to increase government spending to reduce inflation that was largely caused by government spending?

Sometimes I wonder if anyone remembers the basic principles that JM Keynes taught us 100 years ago. The basic idea of countercyclical Keynesianism is that the government can help the private sector when the economy is weak by spending more and that the government can reduce excesses in the economy when the economy is booming by spending less (or saving more). But now that inflation is surging politicians are promoting the exact opposite idea.

I don’t know where this idea came from? I know some MMT advocates were saying the government should spend a lot more during 2021 to fight inflation, but where else did this idea come from? Anyhow, Newsom got roasted and rightly so in my view. The Fed won’t be able to snuff out this inflation by itself and they shouldn’t have to worry about the government spending more and possibly exacerbating the demand side of the equation.

3) ESG investing – where did this idea come from?

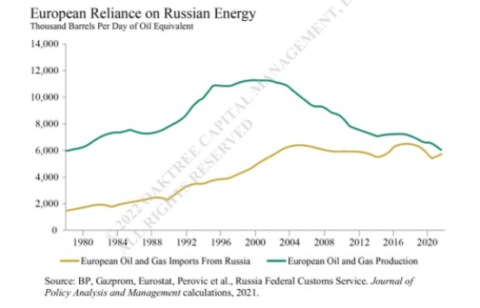

ESG investing was all the rage in recent years. This stemmed from the myth that investors could do good for the world AND earn higher returns. Except the implosion of the oil market is proving  that this concept is, at best, deeply flawed. The trend is best summarized in Europe’s move away from oil and gas production in favor of renewables. Which resulted in them becoming more dependent on Russian oil. Which is now turning out to be a disastrous policy move.

that this concept is, at best, deeply flawed. The trend is best summarized in Europe’s move away from oil and gas production in favor of renewables. Which resulted in them becoming more dependent on Russian oil. Which is now turning out to be a disastrous policy move.

The chart at the right (from Twitter via Oaktree) shows the decline in European oil production which resulted in a rising proportional reliance on Russian imports. Now, I know we want to reduce our dependence on oil and other forms of energy that are environmentally unfriendly, but we also have to be practical about it. The global economy is bringing millions of people out of poverty every year. That’s great news. The thing is, these consumers want to live first world living standards. And first world living standards involve the consumption of gross amounts of petroleum based products. We’re simply not at the point where we can stop relying on oil. Yes, we hope that we can reduce out reliance on oil over time, but this has to be balanced with the huge growth in global demand.

The bottom line is that you can’t have your cake and eat it too here. If there’s one huge lesson from the war in the Ukraine it’s that the world is still uncomfortably dependent on oil. I don’t love that reality, but it’s very much our reality. And while it’s certainly a priority to promote renewable energy we can’t ignore the fact that first world living standards are still hugely dependent on oil.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.