I’ve never been a big fan of discretionary Fed policy. In my opinion the overnight rate is something that should be automated rather than being controlled by the subjective views of a few people at the Fed. This is a major point of contention in economic and political circles as many people argue that discretionary Fed policy leads to an unnecessarily subjective management of QE and interest rates. I broadly agree with this view.

The basic criticism is that a subjective rate policy leaves too much to discretion and is too data dependent. That data of course is well after the fact so it often leaves the Fed being too reactive. And we’re seeing this again this time around as the data rolls in and the Fed is behind the curve. This was my major concern in early 2020:

“I don’t see how there can’t be some inflation that comes out of this…I’m not transitioning into a hyperinflation sort of mentality but I don’t see how there’s any chance that coming out of like, say 2021 or 2022, that if the economy is really rebounding that we don’t have three, four, five percent [core] inflation and I think you could have the Federal Reserve chasing their own tail raising rates.”

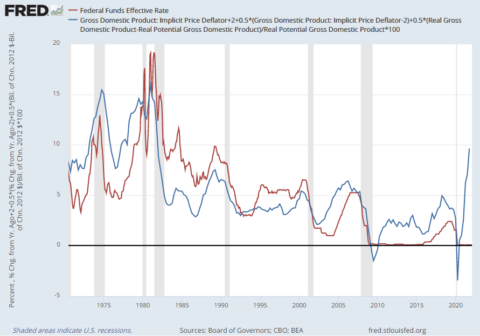

For some perspective on the subjective nature of Fed policy we can look at something like the Taylor Rule, the automated interest rate policy advocated by John Taylor. If the Fed had been using  the Taylor Rule they’d have started raising rates modestly in Q4 2020. This is important because it would have materially altered the demand side equation in the inflation story by offsetting some of the huge fiscal policy that was implemented during the pandemic. At present, the Taylor Rule calls for a jaw dropping 9.5% Fed Funds Rate. Now, that would have been a different story in real-time, but it at least provides some perspective on the timing of rate hikes.

the Taylor Rule they’d have started raising rates modestly in Q4 2020. This is important because it would have materially altered the demand side equation in the inflation story by offsetting some of the huge fiscal policy that was implemented during the pandemic. At present, the Taylor Rule calls for a jaw dropping 9.5% Fed Funds Rate. Now, that would have been a different story in real-time, but it at least provides some perspective on the timing of rate hikes.

I’ve been a bit critical of the Taylor Rule in the past. My basic view is that the original formulation results in these huge swings that create an over-dependence on Fed policy. I’ve advocated for tempering the Taylor Rule by removing the inflation target in the equation which leaves rates a bit lower on average and doesn’t result in the jarring swings that we see in the original equation. Based on this Modified Taylor Rule we’d have started raising rates in the middle of 2021, which seems more than reasonable in my view.

The worry now is that the Fed is again being reactive. Except this time they’re at risk of making a major policy mistake because they are increasingly likely to react aggressively to things that have ALREADY happened. Russia only magnifies this risk as the underlying components of core inflation were starting to ease, but the commodity boom will increase pressure on the Fed to respond to what is clearly a supply shock in commodities.

It’s going to be an interesting couple of years in Fed policy dynamics. Many heterodox economists like MMT advocates argue that Fed policy works because it causes unemployment. That’s why they don’t like it. Yeah, you get lower inflation when the Fed drives the economy into a recession, but you also get surging unemployment. I have sympathy for that view, but I think it’s somewhat naive to think that fiscal policy is a reliable lever for controlling inflation. A more modest interest rate policy is the better balance in my view.

In any case, the Fed is going to have to thread the needle here because there are some very serious unknowns out there. The obvious one being Russia and financial system contagion, but the other one is the boom/bust nature of commodity price shocks and the way they can nuke demand. Energy in particular is a risk because oil price shocks tend to filter through to consumers by diverting spending to things like gasoline. This is why oil price surges tend to precede recessions. There are numerous signs that the economy is starting to slow and the risks are rising. This appears most apparent in the 2s-10s yield curve and Eurodollar futures curve. Can the Fed raise rates without causing a recession?

The car is smoking down the track and the Fed wants to hit the brake hard, but they need to be careful here. Hit the brakes too hard and the semi-truck behind us will crash right through us. As we navigate through 2022 and into 2023 we’ll have to see how Monetary Policy’s “long and variable lags” impact the economy. For now out base case remains muddle through and mean reversion to pre-Covid trends, but an overly aggressive Fed hiking regime would increase the risk of a policy risk in an outlier scenario.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.