What a day. The NYSE halted trading for half the day, Chinese stocks crashed and Greece is always waiting in the wings with arms wide open ready to ravage any hope of a happy day. Let’s talk about all of this.

1) Contagion, contagion, contagion. There seems to be a bubble in the word “contagion”. First up is Greece. This is a country that is equivalent to 0.3% of global output. And in the last 5 years their debt has been almost entirely shuffled onto the balance sheets of sovereigns. In addition, the ECB has created numerous programs that deal with banking crisis. If there was ever a debt crisis that the world was more prepared for then Greece is it. That doesn’t mean there are no risks from Grexit (like other countries exiting), but the actual economic impact from this is likely to be very minimal. Especially outside of Europe. Will there be some contagion? Yes, but this is nothing like Lehman Brothers.

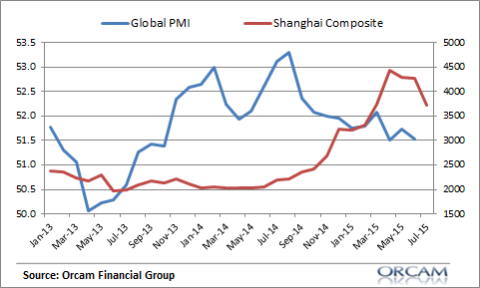

What about China. Isn’t their stock market crash going to crater the global economy? This one is a bigger worry in my view because the weakness in the Chinese economy is going to have a much bigger impact on Asia. Then again, we have to maintain some perspective here. If the crash is going to significantly hurt global growth then shouldn’t the boom have been consistent with global growth? The data clearly doesn’t show that at all:

(Do You See a Correlation Here?)

In late 2014 we didn’t hear anyone saying “this Chinese wealth effect is going to be a huge boost to the global economy”. But as soon as the bubble bursts it’s a global financial “crisis” and it’s the only thing that seems to matter to anyone. Or, could it be that this is just another seemingly scary event that the media trumps up because it’s attention grabbing?

I don’t want to downplay this whole situation. But we should maintain some perspective here. Markets get choppy at times. Uncertainty causes a lot of emotional and irrational pricing. Stocks have been due for a slide for a long time. But when we look at the data for what it is we can comfortably sit back and ask ourselves the only question that matters: “Are Greece and China going to substantially alter what I do every day at work and in life?” My guess is that the vast majority of us will answer no to that question and that means we’ll all look back at these couple of weeks at some point in the future and have a good laugh about it.

2) Thoughts on Disaggregation of Credit & Stock Market Wealth Effects. The big lesson from the Chinese stock bubble is that debt matters. There was an insane amount of borrowing done to purchase stocks during the boom. Margin debt is a great example of disaggregation of credit. That is, margin debt can be used purely for speculative purposes that has zero real economic impact. But the limits of margin debt usage are relatively minimal in most countries. Almost anyone can open a brokerage account and buy a lot more stock than they can actually afford. This is crazy in my view. It adds nothing to the real economy,but risk. It’s a nice business model for the banks and brokers who manage their margin debt positions well, but make no mistake – this is not like productive uses of debt where the borrower is spending for future production, getting an education or buying a home. They are literally just borrowing to speculate. This enhances the casino effect of the stock market substantially.

The other thing that the Chinese stock boom exposes is that “wealth effects” are vastly overrated. We’ve heard about this endlessly over the last few years with QE and how stock prices would lead to a virtuous cycle of spending as net worths increase. I’ve argued that this view is totally backwards. Stocks appreciate because the underlying businesses improve. Not just because we fictitiously increase the demand for them in various ways. Of course, Robert Shiller proved all of this many years ago. The stock market has never had a strong correlation with a “wealth effect”.

3) Is 2015 a Preview of Low Return Markets? This year is turning into a very difficult one for investors. The S&P 500 is negative, commodities are negative and bonds are negative. And it makes me wonder if this isn’t a preview of what’s to come in the decades ahead. That is, we know that bond returns are going to be lousy and stocks probably aren’t going to do as well as many expect. We know that because a 30 year T-Bond isn’t going to generate much more than 3% going forward and that’s pretty much the benchmark rate on long bonds. And we know that stocks are in the latter stages of a market cycle, richly valued by many measures, etc. Using some basic math we know that a balanced 50/50 stock/bond portfolio probably isn’t going to do much better than 5-6% in the years ahead (3% bonds at 50% + 10% stocks at 50% = 6.5%). And if stocks do much better than we expect then that means your portfolio is that much riskier because your risk from a 50/50 will actually look more like a 80/20 portfolio because the stocks will disproportionately drive the risk of permanent loss.

The 80’s and 90’s were a golden age for financial markets. My guess is that the years ahead will prove much more difficult. And it’s one reason why we have to be so much more mindful of taxes and fees. It’s also a major reason why I’ve set the fees at Orcam at a rate that is 65% lower than the industry average. Taxes and fees are going to matter more than ever in the decades ahead because the returns are likely to be worse.

Okay, now I am even depressed. Sorry.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.