Lots of talk about bubbles these days. In this edition of three things I’ll touch on some of this bubble fever.

Before we begin I always think it’s helpful to understand what a bubble is. A bubble is an environment in which the market price of an asset has deviated from the underlying asset’s fundamentals to an extent that renders the current market price unstable relative to the underlying asset’s ability to deliver the expected result. This results in a “price compression” where market participants price in many years worth of future performance into the current price. They are, in effect, buying today with the expectation that future earnings will justify current prices. This can result in a near-term disequilibrium because you have inherently short-term investors bidding up the price based on long-term expectations. You get what is essentially a time mismatch. And if the market doesn’t satisfy current price expectations then investors forget about long-term fundamentals and sell in the near-term which results in a price decompression and a bursting of the bubble.

1) Revisiting the Bond Bubble. The very awesome Mark Dow posted this chart on Twitter last night showing the dramatic shift in inflation expectations in the last few months:

This is something I was talking about in January when this chart was troughing. In essence, the bond market was pricing in a very low rate of future expected inflation. But there were signs that this might not be a totally rational view. I said bonds looked “frothy”. And just a few weeks later we saw the type of negative volatility in the long bond that is very unusual. That is, short-term bonds outperformed long-term bonds by a wide margin as the 10 year yield surged from 1.65% to 2.1%.

The question is – is the bond bubble bursting as many have claimed? I don’t think so. I’ve long held the view that bonds aren’t in a bubble because I didn’t think high inflation was in the pipeline. And I basically continue to think that. I think we’re just normalizing a bit here from unreasonably low expectations. I don’t think there’s a high risk of high inflation in the near-term, however, I wouldn’t be shocked if we continue to see the air come out of the deflation trade in the coming 12 months….

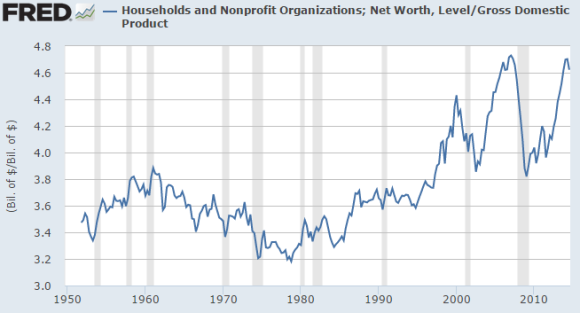

2) Is there a bubble in household net worth? Here’s a chart that should scare any rational person:

This chart is showing the ratio of household net worth to GDP. In essence, it is the market value of what we produce relative to what we actually produce. William Dunkelberg posted a story about this on Bloomberg Briefs citing the existence of a “bubble” in household net worth. Let’s think about this though.

Basically, what’s happened is we’ve had a surge in stock prices as well as a solid rebound in real estate prices. The implication that there is a “bubble” implies that there is a risk of a substantial price decompression. That could certainly be true, however, the stock market is the primary driver of this chart and it is not valued based solely on what we produce. It is based on what the market believes the underlying shares are worth. And one of the primary reasons that there appears to be a permanent high plateau in valuations in the last 20 years is due to the fact that public equity has become increasingly scarce. Total share count and issuance has been on a steady decline. So, you have increasing demand for fewer outstanding shares. Do the math. Valuations must rise.

Now, this doesn’t mean there isn’t a bubble. I’d be a fool to look at the above chart and declare that there is no chance of a bubble here. But I think there’s a good chance that this chart means one of two things: 1) We are in a stock bubble and prices could come crashing down; 2) we are in a permanently high valuation plateau where stock prices might not crash, but will simply underperform relative to underlying growth. The difference between these two scenarios is that stock prices need not “crash” in scenario two. They just won’t continue to surge at the blockbuster pace we’ve seen in the last 5 years. Either way, I’ve argued that future stock market returns are likely to be lower in the future so this story doesn’t have a very happy ending no matter which conclusion you come to.

3) Mark Cuban says there’s a bubble in private markets and that it’s “worse” than the tech bubble of 1999:

The bubble today comes from private investors who are investing in apps and small tech companies.

…

I have absolutely not doubt in my mind that most of these individual Angels and crowd funders are currently under water in their investments. Absolutely none. I say most. The percentage could be higher

Why ?

Because there is ZERO liquidity for any of those investments. None. Zero. Zip.

The only thing worse than a market with collapsing valuations is a market with no valuations and no liquidity.

If stock in a company is worth what somebody will pay for it, what is the stock of a company worth when there is no place to sell it ?”

I don’t doubt that Mark is right. I talk to a good number of private market investors and dabble in these markets a decent amount. Things look a bit more than frothy to me. For instance, there was a hilarious article in Investment News talking about a “bubble” in traditional RIA valuations at 4X when many of the Robo Advisors (who are also RIAs) sell at 150X. Half of those firms will never make a profit, but they are raising cash like it’s growing on trees. So yes, there’s more than frothiness out there.

But this is not “worse” than the tech bubble. The primary difference is that this bubble is comprised of wealthy people living mostly in San Francisco and New York. The tech bubble was a mom and pop bubble. It impacted the whole country. This bubble is much more consolidated. So no, there’s simply no way that this bubble is worse than the tech bubble because its scope is nowhere near as close. That doesn’t mean it’s not a big risk to the economy. Particularly the tech dependent portions of the economy. But it’s not worse than the tech bubble. Not even close.

NB 1 – Steve Brotman of Alpha Ventures was on CNBC today making the same point I made above. He cites that there is about $20-$30B in new private market investment every year. More importantly, the scope of ownership if much narrower. This means that the general public has far less exposure to this bubble. So yes, this might be a micro bubble contained in the private markets, but this is nowhere near the magnitude and scope of the tech bubble because it will not have the same widespread impact since the scope of investors is so much smaller.

NB 2 – Some people have noted that my second point is a bit loose in language since the value of the market shouldn’t rise solely because of fewer shares. My point was that the reduced issuance of new public companies and increasing privatization means that the availability of public companies has been reduced. This means that public companies as a percentage of net worth has been reduced which means that the available public companies are seeing higher demand from investors which could be contributing to higher valuations.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.