Today my email inbox taught me that if you say Mark Cuban is wrong about something you will be called an idiot and very poor (at least in relative terms). In fact, readers will make it abundantly clear that if you are not a billionaire then you really can’t criticize a billionaire because their bank account proves that they have some sort of power equivalent to wizardry. That makes sense I guess (in some fantasy world where money and intelligence are synonymous). Now, there is no doubt that I am an idiot at times (my wife would say most of the time and my dog would say all of the time) as well as poor compared to Mark Cuban, but that doesn’t mean he’s right to call the private market a bubble that is “worse” than the tech bubble.

In order to put this in better perspective I wanted to expand on the point I was originally making. I wasn’t saying that there is no bubble in the private markets. I was simply pointing out that this bubble is not worse than the tech bubble because it is nowhere near as expansive.

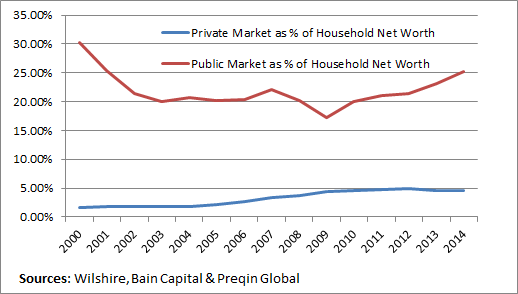

For instance, if we look at the size of the private equity market relative to the public equity market we can see that the private market is dwarfed by the public market:

As a percentage of total assets the private market is growing rapidly. It now represents about 20% of total equity relative to the public markets. But we have to keep things in perspective here. A 30% collapse in the public markets would wipe out over $6 trillion in net worth while a 30% decline in the private markets would wipe out about $1 trillion in net worth. That’s certainly not a figure that’s worth scoffing at, but as a percentage of household net worth we’re talking about a difference in 25% of net worth relative to about 5% of net worth. From a balance sheet perspective the public markets are vastly more important than the private markets are.

In addition, while I don’t have data on this I think it’s safe to say that the private markets are dominated by a much smaller subset of the public so the damage is done to larger wealthier players in general and doesn’t have a wide ranging impact on mom and pop investors in the same way that a public market bubble collapse would.

Mark Cuban might not be wrong to say that there is a bubble in some of the private markets. But when you say that this one is “worse” than the tech bubble I think it’s helpful to put things in some perspective because the collapse of this private market bubble would not have nearly the same macroeconomic impact as the decline in the public markets like we saw during the tech bubble. Is it worse in terms of its size relative to the Nasdaq bubble? Maybe, but when it’s orders of magnitude smaller it helps to put things in perspective. Otherwise we end up saying silly things like the idea that the student loan bubble is similar to the housing bubble….Anyhow, I’ll get back to being poor and stupid now.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.