30 years ago the market crashed 23% in one day. It’s everyone’s worst nightmare – seeing their savings get cut in a quarter overnight. This is obviously traumatic so it’s rational to worry about such an event. There are important lessons in big traumatic events like this so let’s dive deeper.

I have a simple recurring theme about life and markets on this website – life is mostly just a boring trend of similarly monotonous stuff that gets jarred loose every once in a while. Life can feel like a series of cycles, but it’s more like a big boring trend that gets a little out of whack on rare occasion before coming back to trend. The markets aren’t so different. But what most people don’t tell you about the markets is that the big downward busts are usually preceded by big upwards booms.

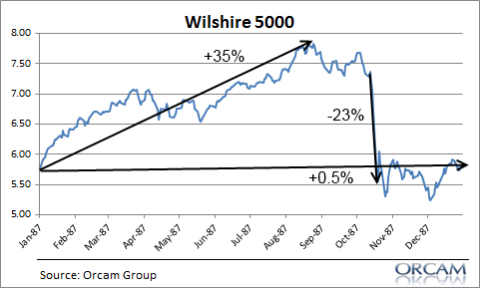

In the case of 1987 the stock market went through an extraordinary 10 month boom of 35% before Black Monday happened. But here’s the interesting thing – if you’d put $1,000 into the stock market on January 1, 1987 and told yourself you would not look at it for a year then you had an account balanced of $1,000.5 on January 1, 1988. 1987 sure was boring, huh?

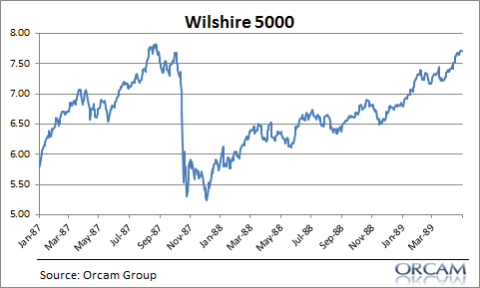

Or what about this? If you had purchased stocks at the top of the market in 1987 and just held on through the bust then it took just 19 months for you to break-even. That’s not too shabby.

Now, in fairness, life isn’t so easy. Maybe you were planning to retire in 1998. Maybe you had a medical emergency in 1988. Who knows? Our lives tend to be a series of short-terms and our assets tend to be more long-term so blending that asset/liability mismatch is a big problem for anyone buying financial assets. Telling people to just “buy and hold” through market crashes doesn’t always mesh with how life actually plays out. So what can we glean from all of this?

- The stock market can be really risky. It’s perfectly rational to worry about it crashing and yes, this sucker always goes down at some point. It’s not always the smooth easy upward glide that investors have grown accustomed to in the last 5+ years. But you can diversify that risk by owning things that trim its volatility. For instance, while a 100% stock portfolio fell 35% peak to trough in 1987 a 50/50 stock/bond portfolio fell just 16%. That’s still a big move, but it’s far more tolerable for most people.¹

- Short-termism is the #1 problem for most investors. The stock market is a long-term instrument and not something to be judged on a daily, monthly or even an annual basis. Based on my calculations the duration of the stock market is at least 25 years so it’s better to think of this instrument as though it’s a super high quality long duration bond. Hold it long enough and you’ll do okay. Worry about its every daily move and you’re creating unrealistic expectations of what this long-term instrument can do for you.

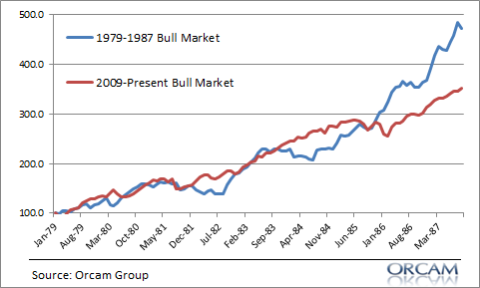

NB – People sometimes compare today’s environment to markets like 1987, but this bull market kind of sucks compared to the 1987 boom. You had a nearly 5X increase from the trough in 1979 to the peak in 1987. Today’s market is barely pushing 3.5X from 2009.

¹ – Lawrence Hamtil makes a nice point on Twitter that I should have thought of – owning foreign stocks further diversified your holdings as the decline in the dollar helped insulate your domestic holdings. While the MSCI USA index finished the year +3.9% in 1987 the World Ex-USA was up +24.5%.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.