Countercyclical Indexing is based on a simple premise – a “balanced” index such as 60/40 is a relatively inefficient rebalancing approach because it always rebalances back to an equity weighting that is unbalanced in terms of where the relative asset class risk comes from. This is because 85% of the volatility in a 60/40 portfolio comes from the 60% stock slice.

This is exacerbated across market cycles as the stock market booms and busts. This leaves the investor overexposed to drawdowns when stocks are riskiest and exposes them to high levels of behavioral risk. As John Bogle explained in 2018, it makes more sense to rebalance against what the relative market cap is doing in order to mitigate behavioral risk and portfolio volatility.

This can be achieved using a systematic countercyclical strategy that buffers the stock market risk and better balances the relative asset class risks. That is the goal of the Discipline Index – to construct a low fee, highly diversified, systematic

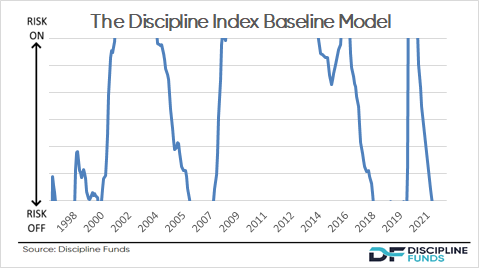

The Discipline Index is our baseline asset allocation metric that measures the relative risks of stocks and bonds across time. The Index measures macroeconomic and financial conditions to quantify the current risks in the market to provide a systematic model for a diversified indexing approach that helps better balance risks in a portfolio across time.

Why Does Countercyclical Indexing Work?

White Paper – What Is Countercyclical Indexing?

The Best Investment Strategy – Discipline

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.