Jeffrey Sachs took Paul Krugman to task over the weekend due to his 2013 concerns over the “austerity” in the USA. Krugman had repeatedly expressed concerns that the economy could slip if the government implemented austerity measures. Krugman was obviously wrong to get too worried about the US economy in 2013 and as I stated on several occasions, the US economy was not at risk of a recession due to government “austerity”. The actual spending cuts were virtually insignificant as I showed here. So Sachs is also wrong to declare that this was austerity.

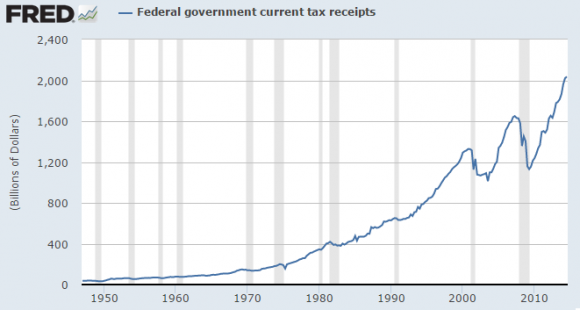

Back in 2013 I repeatedly said Krugman was wrong to be calling the USA’s shrinking deficit “austerity”. The reason is simple – the deficit wasn’t shrinking due to discretionary spending cuts. In fact, spending has been rising. But the government has experienced a boom in tax receipts in the last few years which means that the deficit was shrinking due to a private sector expansion, not discretionary spending cuts.

It appears that Sachs and Krugman are both erroneously referring to this as austerity which has led to some muddled conclusions. I don’t know what’s going on here because it’s obvious that the US government hasn’t really implemented any meaningful austerity. But Krugman and Sachs appear to be engaging more in politics than economics. That’s the only way I can explain why they both seem to think that there’s been “austerity” in the USA when there very clearly has not.

If we’re going to come to sound conclusions about economic cause and effect it’s helpful to actually look at what’s driving things like the deficit rather than just concluding that the deficit’s current state is necessarily a sign of something good or bad. Anyone who assumed that the falling deficit in recent years was necessarily bad for the economy was just not looking at what was driving the decline and this led many people to make bad predictions about what it meant for the economy. Politics appears to have muddied some of the thinking here as well. As always, understanding the monetary system for what it is rather than what you want it to be is a helpful way to analyze the financial world.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.