As I’ve explained previously, there is only one portfolio of all outstanding financial assets. So it makes sense that the benchmark against which we should judge the financial markets are much broader than just the US stock market or even the global stock market. In fact, at present the global bond market is substantially larger than the global stock market.

Unfortunately, it’s not easy to put together a simple portfolio to measure the performance of such an index and there’s no widely agreed upon set of instruments that should go into this index. We can, however, with some degree of precision, calculate roughly what such a portfolio will look like at any given time.

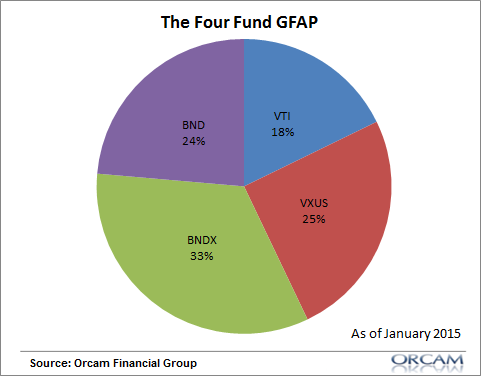

This excellent paper goes into the modeling of such a portfolio in some detail. But even this methodology can result in rather imprecise outputs and difficult implementation. Instead, I looked at the two major asset classes in the world and constructed a simple four fund Global Financial Asset Portfolio with updated weightings for 2015. This portfolio will capture over 95% of the financial asset weightings listed in the aforementioned paper, but makes implementation and performance tracking far easier.

Using data from World Exchanges and the Bank of International Settlements I was able to calculate the current market cap of the global stock and bond markets. The total stock market is 43.2% of the total outstanding financial assets while the bond markets represent 56.8% of the outstanding financial assets. So, almost the exact opposite weighting of the widely cited 60/40 stock/bond index which has become so popular in recent years. And if you deviate from that rough 43/57 weighting then you are making an active bet against “the market”.

At present the USA represents roughly 41% of the total world stock markets while the foreign markets are 59%. US bonds represent 41.38% of the total bond market while foreign bonds are 58.62%.

To apply these weightings to a simple four fund portfolio we can use the Vanguard Total Stock and Bond Index funds. The weightings are not perfect, but they are more than 90% accurate representations of the aforementioned weightings. The output is as follows:

This is a bit different from my previous calculation of the GFAP where I included specific weightings for assets like REITs and more specific fixed income allocations, but I think this is a cleaner and simpler way to track the performance. Most importantly, this is a very low fee and relatively simple index which makes the implementation much more realistic and in-line with the ideas that “passive indexers” often espouse (essentially, keep it simple stupid).

I’ll be updating the index as the year goes on as I believe this is a far more important benchmark than most of the traditional benchmarks that are currently used in the mainstream media and in many performance metrics. In fact, this might be the most important benchmark that any of us follows going forward given that it’s the closest representation of “the market” that we have.

NB – Please note that I do not believe this is the ideal portfolio nor do I “recommend” investing in this portfolio. As I’ve explained previously, this portfolio can have serious flaws and is inappropriate for most investors.

Sources:

1. Global Market Capitalizations, World Federation of Exchanges, November 2014.

2. The Global Multi-Asset Market Portfolio, Ronald Q. Doeswijk, Trevin W. Lam & Laurens Swinkels, January 2014.

3 – Is the Global Financial Asset Portfolio the Perfect Indexing Strategy? Roche, Cullen

4 – Debt Securities Statistics, BIS

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.