I usually don’t bother writing much about the non-farm payrolls data because it’s a notoriously impossible figure to predict. Nonetheless, we always get the chorus of analysts and pundits who predict what the figure will be and it’s always a market moving event. With the consensus at 205K I am beginning to wonder if recent data isn’t being overlooked. Specifically, both the ISM Services and Manufacturing showed weakening employment in February. Small businesses are warning about hiring (via Joe Weisenthal):

“Mostly people are very bullish ahead of this Friday’s jobs report, and estimates among some on the street are in the high 200K range.

While we wait for Friday eagerly, we continue to look for every scrap of data to feed our hunger to learn what’s happening in the labor market.

To that end, the latest announcement from the NFIB is not good.

The organization that represents small businesses says net new job creation among their members was rather poor in February.

There was actually a very big decline in the net number of new firms planning on adding workers.”

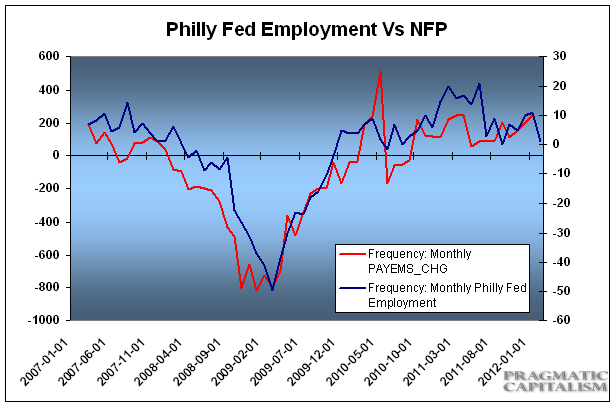

And then we’ve got the Philly Fed data, which I highlighted last month. Jack Ablin is one of the few analysts with a decent track record of NFP predictions and he focuses largely on the Philly Fed Employment data. As you can see in the following chart I put together, the correlation between Philly Fed Employment and NFP data is very high. The recent decline in the Philly Fed survey is indicative of a substantial miss in the NFP data:

Monthly payrolls are notoriously impossible to predict, but with the Citigroup Economic Surprise Index at elevated levels and the economy still relatively sluggish I have to wonder if the predictions of upside surprises haven’t started to get excessively optimistic….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.