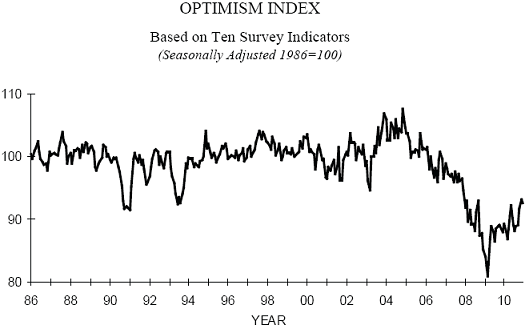

While Wall Street continues to proclaim the “all clear” for the economy Main Street continues to dig itself out of an enormous hole. This morning’s Small Business Optimism survey from the NFIB marked the 36th month of recessionary levels:

“The Index of Small Business Optimism lost 0.6 points in December, not a huge change but not the hope-for rebound that would signify more growth in the small business sector. Apparently, the “management change” in Washington and marginally better retail sales numbers were not enough to pump up spirits at the New Year celebrations. This marks the 36th month of recessionary levels. Only once in that period did the Index get above 93 (last month) and has been below 90 for 26 months.”

Labor markets are slightly improved:

“Thirteen (13) percent (seasonally adjusted) reported unfilled job openings, a four point improvement that anticipates a reduction in the unemployment rate in the coming months. Over the next three months, 10 percent plan to increase employment (up one point), and nine percent plan to reduce it (down three points), yielding a seasonally adjusted net six percent of owners planning to create new jobs, a two point gain from December and the best reading in 27 months. Until sales picks up, there is no pressing reason to hire. The reduction in the payroll tax will add some impetus to hiring as most of that addition to take home pay will likely be spent.”

Revenues were flat:

“The net percent of all owners (seasonally adjusted) reporting higher nominal sales over the past three months worsened by one point to a net negative 16 percent, 18 points better than March 2009 but still indicative of weak customer activity. The net percent of owners expecting higher real sales continued to rise, gaining two points to a net eight percent of all owners (seasonally adjusted), an 11 point gain since September. Plans to add to inventories fell three points to a net negative three percent of all firms, consistent with mild dissatisfaction with current stocks and weak sales trends, but not consistent with the improved outlook for real sales volumes, a confusing picture.”

Inflation remains benign:

“The downward pressure on prices appears to be easing as more firms are raising prices and fewer cutting them. Fourteen (14) percent of owners (unchanged) reported raising average selling prices, and 20 percent reported average price reductions (unchanged). Seasonally adjusted, the net percent of owners raising prices was a net negative five percent, only a point different from November. Still, December is the 25th consecutive month in which more owners reported cutting average selling prices than raising them.”

Overall, they say the environment is not good, but not horrible either:

“It appears that the small business sector remains in a “rut”, unable to find reasons (drained by a 2 plus year recession period) to ramp up hiring and capital spending. The top problem remains weak sales, spread over too many firms. With weak sales prospects, hiring or spending on capital projects have little likelihood of paying off and therefore will not happen. Congress passed or tried to pass a ton of legislation that had little to do with helping the economy. It is no wonder that consumers and owners are in a canyon of pessimism, the recession took a huge economic toll and the leadership inspired fear, not confidence. With the small business sector on the sidelines, it is hard to get national growth above the 2 to 3 percent range and the economy will not enjoy the type of rebound experienced after 1982 when GDP grew eight percent for over a year.

With the threat of higher labor costs from the health care regulations (being written, so still not understood) and others labor directed regulations, policy is still a job creation depressant. A worker must be able to at least earn their pay if they are to be employed. Adding new labor regulations such as those in healthcare make this hurdle even harder to overcome.

OK, so getting out of the recession “rut” won’t be easy. Government is not on the side of the “angels” so investment and job creation will continue to face headwinds. But, the private sector is strong and will bear the cost of larger more intrusive government. We can certainly “hope for change” here, but history warns against a lot of optimism. Unfortunately, it will keep us from reaching our potential. There were signs of improvement last month and therefore it looks like we will get a bit more job creation and capital spending in the first quarter, sales will be better, profits will improve. There will be more inflation, something the Federal Reserve is wishing for. But, a “gangbusters” year (like 1983 or 1984) is not in the cards.”

Source: NFIB

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.