In his interview on CNBC yesterday Warren Buffett mentioned the fact that Europe was experiencing the equivalent of a run on their banking system. In a recent report, Samsung Securities elaborate on what they believe will become a “significant” run on Italian banks:

“In the meantime, a more immediate issue confronting investors is whether we are likely to soon witness a significant run on Italian-based banks. If the answer is yes, then this without question will be the end of the road for the eurozone and will confront the ECB and Germany with an inescapable choice of either providing unlimited support for all eurozone commitments (including deposits) or allowing the disintegration of the euro.

The good news is that as of Sep 2011 (the latest numbers available from the ECB and Bank of Italy), there was no evidence of a “run” on Italian banks. The overall deposits within the system were only down around 1% YoY to €2,154bn and indeed remained relatively stable throughout turbulence of the past 12 months. Does it mean that so long as the ECB partially stabilizes sovereign yields, all is clear? The answer is an unequivocal no for three reasons:

1. As the cases of Ireland and Greece have illustrated, there is a time lag between heightened pressures and outflow of deposits. Resident holders are generally reluctant to move funds out of their home country unless there is a pressing need to do so. For example, in the case of Greece, the first request for IMF assistance was made in Apr 2010, but the actual outflow did not commence until around Nov-Dec 2010. If we compare to the high level of deposits (Apr-May 2010), Greece has so far lost around 20% of its deposits and the pace of losses is accelerating. Ireland has thus far lost around 25% of its deposits. On the other hand, Portugal has not yet sustained any losses.

2. In the case of most countries that suffer from a run on deposits, the process usually starts with corporate and in particular financial institution accounts. For example, FI’s deposits in Irish banks peaked at around €530bn in early 2009 and started to rapidly recede prior to reductions in other deposits. Today, Irish FI accounts hold around €350bn-€360bn (down 32% since 2009). Similarly, Greek FI deposits peaked at almost €150bn in May 2010 and have dropped now to around €110bn (down more than 25%). Although Portugal’s overall deposit base remains unaffected thus far, in the FI area, the numbers were down around 10% in the past 12 months. Do we have similar trends in Italy? At this stage there is evidence of only limited withdrawals, with three-month average deposits down to around €710bn-€720bn from around €780bn, but deposits were actually up in both August and September this year.

3. In the case of most countries that are starting to suffer from deposit outflow, the banks have to increasingly rely on higher interest rates to lure depositors. Is this starting to happen in Italy? The answer is yes, particularly in the case of corporate accounts. The spread on new deposits against German rates is now around 150bps for corporates and 100bps for households. Although not as aggressive as Greece, where spreads on corporate accounts are now around 250bps or Portugal where it exceeds 300bps, Italy is offering higher inducements vs (say) Spain.

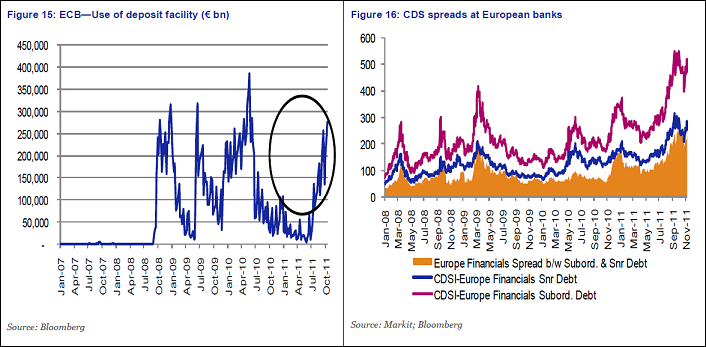

4. One of the key leading indicators of a bank run is the bank’s increasing reliance on ECB’s refinancing facilities. Over the past three-to-four months, we have seen increasing reliance by Italian banks on eurosystem refinancing. Whereas in 2008 and 2009, Italian banks were average users of ECB facilities, accounting for only 3-4% of the total vs Italy’s share of 13.7% of the eurozone’s banking assets. However, since July, the share of ECB’s refinancing attributable to Italian banks rose to a historically high level of 18.8% (end-October). For example, in August, Italy got €85bn from the ECB, a further €105bn in September, and €111bn in Oct 2011. Although as a percentage of total assets, countries such as Greece and Ireland are far more reliant, Italy’s share is going up rapidly.

….markets remain frozen

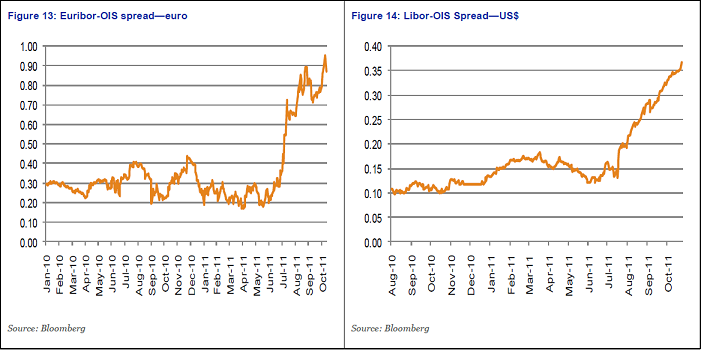

Banking refinancing markets remain largely closed. Whether one looks at OIS spreads (90bps on the euro), ECB deposits or CDS spreads between the eurozone’s senior and subordinated debt (235bps) remain at extremely elevated levels, indicating extreme reluctance of banks to lend to each other for longer than overnight or preference for depositing funds with the ECB rather than lending.”

It’s clear that nothing has been resolved in Europe and the risks are growing with each passing day….They must be more proactive in avoiding what has the potential to turn into a truly devastating economic collapse.

Source: Samsung Securities

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.