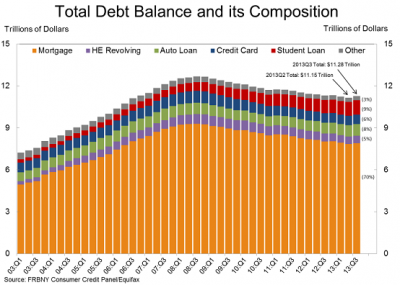

Late last year I said the Balance Sheet Recession was over. And this quarter’s household debt survey from the NY Fed pretty much confirms that. This was the first year over year increase in debt since 2008. It’s a pretty momentous occasion in my view as it changes the dynamics of the economy from one in which we were de-leveraging to one which is now officially re-leveraging without government aid.

Here’s more from the NY Fed:

“The Quarterly Report on Household Debt and Credit for the third quarter of 2013 shows the first substantial increase in outstanding balances since 2008, when Americans began reducing their debt. As of September 30, 2013, total consumer indebtedness was $11.28 trillion, up 1.1 percent from its level in the previous quarter, although still 11 percent below the peak of $12.67 trillion in the third quarter of 2008.

Mortgages, the largest component of household debt, increased by 0.7 percent in the third quarter of 2013. Mortgage balances shown on consumer credit reports stand at $7.90 trillion, up by $56 billion from the level in the second quarter. Balances on home equity lines of credit (HELOC) dropped by $5 billion (0.9 percent) and now stand at $535 billion. Household non-housing debt balances increased by 2.7 percent, with gains of $31 billion in auto loan balances, $33 billion in student loan balances and $4 billion in credit card balances.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.