I was on Twitter talking about how Donald Trump knows nothing about monetary policy and how Jerome Powell and the Fed should ignore him. It’s true. Trump really knows nothing about this stuff. For instance, take a look at some of his old Tweets on QE. They’re basically a rambling mess of hyperinflation predictions.

The Fed’s reckless policies of low interest and flooding the market with dollars needs to be stopped or we will face record inflation.

— Donald J. Trump (@realDonaldTrump) September 29, 2011

Anyhow, pointing this out made some people angry and they said that Trump was “right” because stock prices had boomed – there had been “asset inflation”. This is a weird view coming from Trump since he had referred to the stock market as a “bubble” in 2015 when it was 30% lower than it is today before winning the Presidency and becoming the stock market’s biggest cheerleader after it was even more “bubbly” than it already was.

“@Riggs101: Carl Icahn: Donald Trump Is Completely Correct That “We Are In A Bubble Like You’ve Never Seen Before”

— Donald J. Trump (@realDonaldTrump) June 21, 2015

Trump isn’t the only person who buys into all these bad narratives though.¹ It’s common to see people argue that QE caused inflation in asset prices (let’s call it assflation for short). Now, we should be clear about what this means. Assflation means that asset prices are higher than they should be because the Fed printed a bunch of money. Let’s explore this in more detail.

Before we get into the nuts and bolts here it’s important to differentiate between consumer prices and capital goods prices. When the value of consumer prices rise it means that the things we consume are becoming more expensive. If you have to eat 10 cheeseburgers every day to survive then you would want the price of cheeseburgers to remain stable or else your living standards could deteriorate. When the value of capital goods increases it means the value of the things that reflect our productive spending are increasing. For instance, if stocks rise it is generally because the market is revaluing the future expected cash flows of our capital goods. This is a good thing as it means that our capital goods generate more cash flow with which to consume other goods.

It’s pretty clear that the CPI has been low for a long time. QE did not cause out of control increases in consumer prices. But capital goods prices have recovered significantly since 2009. Now, the reason we don’t include things like the stock market (which reflects changing values of capital goods) in the CPI (which reflects changes in consumption goods) is because rising stock prices are generally a good sign while rising consumer prices are generally a bad sign (all else equal and all of that, of course). We want our capital goods to increase in value because that means our spending on future production has generated a positive return. Then again, we want them to increase in value for fundamental reasons, not just because investors are overreacting or because the Fed is printing money.³

Circling back to QE – there is very clear evidence that the rise in capital goods values has been supported by fundamentally positive changes in the economy. You can measure this empirically by looking at things like GDP, industrial production, corporate profits, etc. There has been a significant empirical improvement in the capital goods side of the economy. So a rise in the value of capital goods is rational. You could even argue that the rise in capital goods has been fundamental and so fundamental that investors now expect it to continue into the future to an irrational degree. In other words, the stock boom was based on perfectly rational reasons that, if they don’t continue, will sow the seeds of the stock market’s next downturn. Ie, none of this necessarily derives from QE or assflation.

Of course, the stock market is trickier than that. It’s a lot like child driving a go-kart around a circular track. They will mostly move forward for rational reasons, but they tend to hit the walls more than they should. So it’s fair to say that the stock market gets a little out of control at times. I won’t sit here and pretend to know what percentage of the stock market’s rise has been fundamental vs irrational. In fact, I tend to think that high multiples and late cycle stock market booms (like we’ve seen in recent years) are consistent with unsustainable or unstable trends.

Lastly, and most importantly, the assflationists fail many out of sample tests. For instance, the Bank of Japan has been doing QE on and off for 20 years. Japanese stocks have gone nowhere. Europe has been doing QE since 2009 and the Euro Stoxx 600 is flat since 2013. The only market that has outperformed is US stocks, in large part because of the tremendous outperformance in a handful of technology names that have gained monopolistic like footholds in certain places.

Bottom line – don’t let the assflationists fool you into thinking that this was all caused by QE. There are perfectly rational reasons for the rise in capital goods values. And there could also be perfectly rational reasons why those values need to come down in the coming years.

¹ – This sickness is what I refer to as “Fed Derangement Syndrome”. It tends to infect Austrian Economists, Bitcoin advocates and people who have a politically biased view of how money is created.²

² – Belief in assflation is an advanced form of Fed Derangement Syndrome. There are no known cures for late stage FDS although this reading material has shown some signs of helping reverse it.

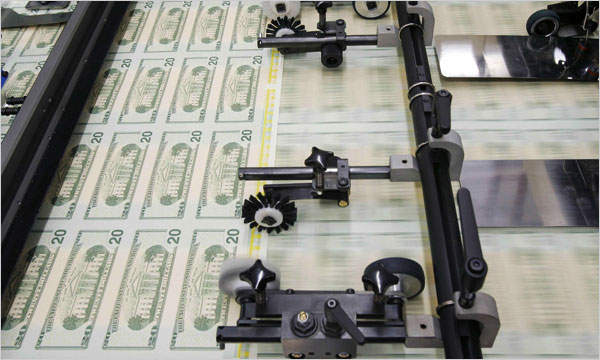

³ – The Fed doesn’t really print money. The US Treasury prints physical dollars and sells them to the Fed to distribute to holders of existing bank accounts. QE involves the Fed expanding its balance sheet to buy an existing private sector asset. Importantly, the Fed’s balance sheet is essentially an “off balance sheet” balance sheet. That is, when the Fed creates a reserve deposit to buy a T-Bond they give the private sector a reserve and take away the T-Bond. That T-Bond isn’t used to go buy groceries or fund consumer spending as it might do if you or I held it. The Fed holds it off balance sheet in what is similar to putting it in a hole in your backyard. In fact, its income is remitted to the Treasury where it is used to reduce the deficit so it could actually be argued that this T-Bond is worse than off balance sheet. It’s not only out of the productive economy, but it’s earning income that the private sector doesn’t earn and actually reduces the size of the government deficit.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.