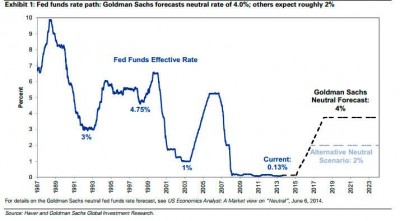

Here’s the completely opposite side of the view I presented the other day on interest rates. Instead of permaZIRP, Goldman Sachs sees the Fed starting to hike rates in 2015. And not just raising them but launching them to 4% by 2018. Here’s what the Wall Street Journal passed along:

“We forecast a dramatic divergence between stock and bond returns during the next several years,” a Goldman team led by stock strategist David Kostin wrote to clients this week. Goldman predicts the S&P 500 will generate a 6% annualized total return between now and 2018, compared to a 1% annualized gain for the benchmark 10-year Treasury note, assuming the Fed starts raising rates in the middle of next year.

…

Stocks typically perform well in the months leading up to an initial rate increase, Goldman says. For instance, when the Fed first raised interest rates in 1994, 1999 and 2004, the S&P 500 rallied 11%, 21% and 18%, respectively in the 12 months prior to those moves. The market then declined in each of those subsequent one- and three-month periods following a rate increase.

“These price responses are largely consistent with an initially improving economic backdrop benefitting equity returns, followed by a corresponding decline in equity valuations as the Fed constrains further upside with tighter financial conditions,” Goldman said.

To put that in some historical perspective, here’s the Goldman forecast:

(Chart via Financial Akrobat)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.