It’s no secret by now that gold prices have been on a near parabolic rise for the last few weeks. This can be disconcerting for obvious reasons. When an asset price rises upward like a rocket ship, you inevitably experience a situation where the asset becomes distorted from its real value. In other words, a bubble is generated and an ensuing disequilibrium develops that leads to an unstable environment which eventually collapses on itself. We’ve seen it time and time again in markets. I personally think this is inevitable in the gold market, but I don’t think we’re quite there yet. And I think the current correction may be a positive sign that the market has just avoided a near bubble event.

One good way of thinking about bubbles is to think about a motorcycle’s process of accelerating forward. If you’re familiar with riding a motorcycle you understand a few very basic things. First, you have to accelerate to create stability. The bike doesn’t stay upright without generating forward momentum. But like financial markets, stability can create instability. For instance, one might conclude that greater forward momentum on a motorcycle will generate even greater stability. But this is not always the case. Stability can and does create instability. In the case of a motorcycle, we can experience what is known as a “death wobble” or a “speed wobble”. This is when one of the bike’s pivot points oscillates quickly (usually at high speeds), losing control and creating an even greater amplitude of instability. In short, the bike’s wheels literally wobble and the system crashes as the rider loses control.

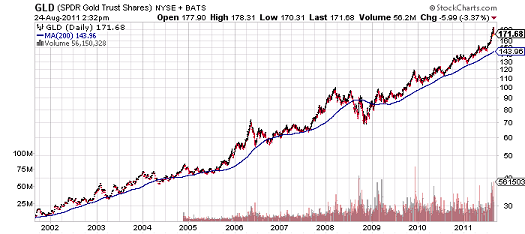

This is what happens in financial markets when a seemingly stable environment becomes unstable and results in a bubble. This can be visualized to some extent using technical analysis. For instance, gold’s ascent has been rather orderly. A 10 year chart shows this steady ascent:

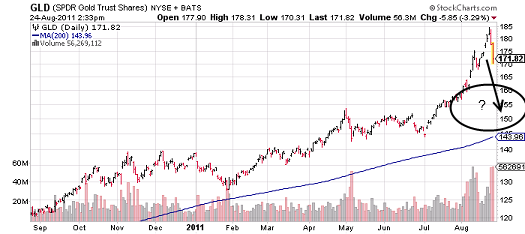

If we look a bit more closely though, we can see that there was some instability building in the market recently. The recent run-up was just the third time in 10 years that the market approached a 30% deviation from its 200 day moving average.

There’s no formula for understanding the point at which a wobble becomes a death wobble in the marketplace, but it’s my opinion that the current correction is a healthy correction that will hopefully continue consolidating down to healthier levels. By consolidating, we can actually create stability in what was becoming an unstable market.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.