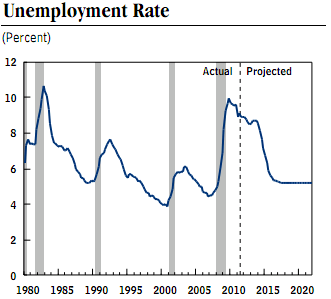

Do you want the bad news or the really bad news? Let’s start with the bad news. Since the balance sheet recession is likely to persist for several more years, there’s a high probability of weak consumer driven growth. The bad news here, is that consumers aren’t likely to get much aid from the labor market in the coming years. At least according to the most recent projections from the CBO’s latest economic outlook. The CBO projects 8%+ unemployment to persist into 2013:

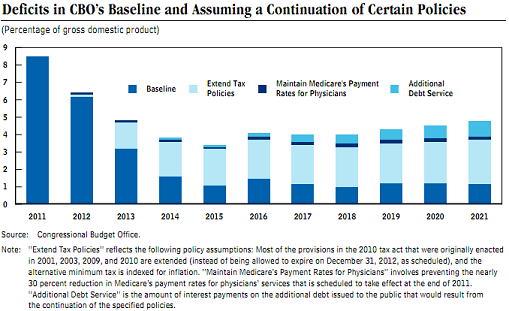

The really bad news is that the impact of the deficit cutting bill that was recently passed by Congress is likely to include deeper cuts than initially presumed. The CBO says the baseline deficit will be below 3.5% of GDP in just TWO years if the Bush tax cuts don’t get extended. Even with the tax cuts, the deficit drops below 5%. Of course, some economists are touting this as a good thing as they claim that this will help the USA “pay off” the debt, but regular readers know there’s no such thing.

Instead, what a 3.5% deficit will do in 2013 (assuming the balance sheet recession is still with us) is delay the necessary balance sheet rebuilding that consumers so desperately need. In fact, this budget could actually drive consumers back into debt which will only make our current matters worse by essentially kicking the can and delaying the inevitable debt de-leveraging for a future date. More likely though, as the government reduces its spending, economic growth will remain stagnant as the consumer fails to transition into a position where they can carry the baton without the government’s aid.

Source: CBO

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.