This is definitely my favorite Donald Trump GIF:

In keeping with that spirit, here are some things I think I am thinking about:

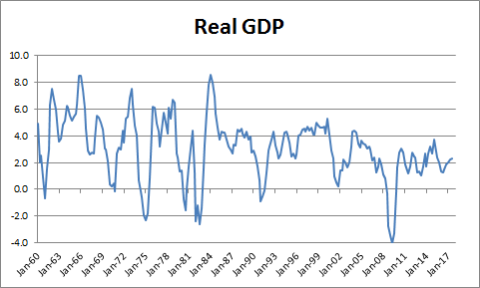

1. “The US economy is booming” – WRONG

Here’s Donald Trump talking about the “booming” state of the US economy:

Will soon be heading to Davos, Switzerland, to tell the world how great America is and is doing. Our economy is now booming and with all I am doing, will only get better…Our country is finally WINNING again!

— Donald J. Trump (@realDonaldTrump) January 25, 2018

This is, um, not right. One could even say “WRONG”. In a sea of perpetual negativity since the crisis I’ve been consistently saying that the US economy is doing better than most people think. But booming implies something that is very high growth. And that’s just not happening. See the chart below and lop on today’s relatively slow 2.6% GDP reading and you can clearly put this one in the “WRONG” category.

2) “The US Dollar is a sign that the markets hate Trump’s policies” – WRONG

Here’s Nobel Prize winning economist Paul Krugman saying the falling US Dollar means the markets hate Trump’s policies:

For what it’s worth, however, the weakness of the dollar — now well below its pre-election level — is a pretty clear sign that markets don’t believe in a Trump boom as opposed to being generally optimistic about world growth 3/ pic.twitter.com/A3FSO8OXt2

— Paul Krugman (@paulkrugman) January 25, 2018

This is, um, not right. One could even say “WRONG”. Now, I didn’t win a Nobel Prize in foreign trade, but I have traded a shit load of foreign currency in my career. And here’s the thing, the US Dollar reflects a relative state of change. So, if the USD is falling it could be because the US economy is becoming very weak. OR, it could be because the US economy is getting stronger AND another economy is getting a little bit stronger. In fact, the US economy could be booming and another economy could be booming more and the USD would still fall in relative terms. That’s not what’s happening (see above), but you ge the point.

Of course, this doesn’t even touch on the multitude of other factors that influence the Dollar exchange rate like interest rates or sentiment or Central Bank actions. But it is not right to say that the current state of the USD reflects a lack of faith in Trump’s policies. So it’s very strange to see Krugman espousing this view that he must know is wrong or at least misleading.

3. “You should be worried about the shrinking US stock market” – WRONG

The shrinking US stock market has been a consistent source of alarmist articles in the last decade or so. But don’t worry, Vanguard is here to bring some sense to the conversation. In this podcast they show how the shrinking US market is due entirely to the shrinking microcap market and that the overall impact hasn’t had any impact on total market cap. Have a listen here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.