* – This is an updated post from 2015 that remains relevant.

There’s usually two forms of ideological rhetoric that accompany low interest rates. The first is that the Fed has “manipulated” interest rates lower. And the second is that the Fed is “punishing savers”. These myths have scared people away from stocks and bonds and left them frozen in cash or worse, chasing commodities and gold. So let’s take a look at each of these ideas because some clarity might help put things in a more practical perspective.

Has the Fed “Manipulated” Rates Lower?

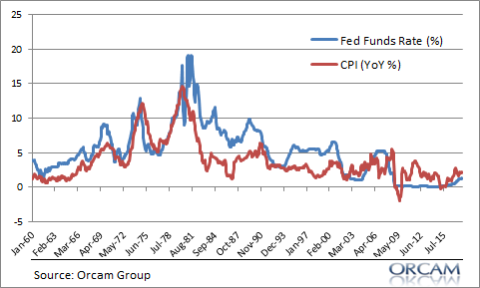

The first misunderstanding has to do with Fed policy and its setting of interest rates.¹ The Federal Reserve controls the overnight interest rate. It can set this rate with precision because it is the monopolist of reserves. But the Fed sets the overnight rate based on the state of the economy. If the economy is weak and inflation is low then the Fed sets low rates. If the economy is strong or inflation is high then the Fed sets a high rate. We should be very clear about what’s happening here – the Fed is assessing the state of the economy and then setting rates. As you can see below the Fed Funds Rate is, at best, a coincident indicator rather than a leading indicator.

(Is the Fed chasing inflation or driving inflation?)

It’s important to understand that the state of the economy determines interest rates. And we see this across the spectrum of other instruments that the Fed does not control. For instance, the 30 year T-Bond, which is not controlled by Fed policy, is also near historical lows. In fact, the 30 year T-Bond has moved inversely to Fed policy in each of the last 2 rate increase cycles. This is because bond investors are not demanding a high rate of return because inflation is presently low. The same is true across the spectrum of other types of bonds. The global bond market is the deepest and most liquid market in the world. While Central Banks have an influence on this market it is irrational to argue that they can control all the prices in this market.

Let’s look at things from a more operational perspective. The Federal Reserve is the monopoly supplier of reserves in the overnight market where banks are required to hold some level of reserves. This means that the Fed determines the cost of its liabilities. As a natural monopolist the Fed is a price setter, not a price taker. Therefore, the Fed cannot “manipulate” the cost of its liabilities. Manipulation implies that “the market” should determine the cost of reserves, but there is no “market” in reserves. The Fed supplies reserves and determines the cost of those reserves by managing the quantity and price of those reserves.

In addition, the natural rate on overnight loans is 0%. This must be true because the Fed requires banks to hold reserves. As a result of this the banks will naturally try to bid down the overnight rate to 0%. The Fed has to force the rate higher by incentivizing banks to hold reserves. It does this presently by setting the interest on excess reserves. But this is an important point – people think the Fed manipulates overnight rates lower when in fact they are always setting them higher than they otherwise would be.

There’s a reasonable response to this – that the Fed itself is a “manipulation”. This is true of course. The Fed was created as a clearinghouse for the interbank market. But this was done to mitigate the risks caused by allowing banks to manage this process on their own. And we know from the persistent crises of the late 1800’s and early 1900’s that banks aren’t always good at managing their risks and certainly shouldn’t be managing the payment system entirely on their own because, as private profit seeking entities, they are prone to risk taking, booms, busts and economic contagion due to their centrality in the economic system.

Some other possible responses to this:

- “QE has manipulated longer rates lower!” No, it hasn’t. If QE “worked” then it would have strengthened the economy, caused high inflation and rates would be higher. After all, the whole purpose of QE was to create higher growth and high inflation.

- “The government inflation data is all wrong!” The government’s inflation data is hardly perfect, but it’s a stretch to argue that it’s all wrong. After all, if the inflation data is fake or misleading then why are interest rates across the entire bond market so low? If inflation was in fact higher then the market would demand much higher rates on bonds.

- “The inflation is all in asset prices!” Asset price inflation is not consumer price inflation. But this misses a more fundamental point – low inflation is good for stock prices because it reduces the cost of capital and makes future income streams more stable. Stocks should benefit from low interest rates and more importantly, low inflation.

Has The Fed Punished Savers with Low Rates?

The second form of ideological rhetoric that often accompanies low interest rates is the idea that savers get “punished” by low interest rates. If you look at a portfolio of equal weight stocks, bonds and cash the total return over the last 10 years is 4.8%. A portfolio of 100% total bond market generated 4.11% per year. A portfolio of 80% cash and 20% stocks generated 2.57% per year. This includes the financial crisis! So it’s illogical to argue that savers have been punished during this period when fairly safe portfolios have generated decent real returns.

There’s a more fundamental misunderstanding here regarding asset allocation. As I mentioned in my recent speech on the state of the markets, cash is the absolute worst asset to hold for the long-term because you are guaranteed to generate a negative real return. This is true when cash yields nothing and when it yields higher rates. So a real “saver” should never have all of their savings in cash.

Of course, this isn’t what these people are usually referring to when they think of “savers”. What they really want is risk free income. And that usually comes from the US government as a function of the Fed’s policies. Ironically, these complaints tend to come from “hard money” and anti government types. And in arguing for risk free income they’re essentially asking for a handout from the US government in the form of higher interest payments from Uncle Sam. In doing so they’re arguing for a higher government deficit and debt since interest income is one of the largest expenses in the budget deficit.

Lastly, these “free market” thinkers should love 0% interest rates. Not only does it set overnight rates at the natural rate of 0% (since banks will naturally bid down the cost of reserves in the overnight market), but it reduces the deficit, government debt and allows private entities to increasingly bear the burden of paying interest income to the private sector. What’s not to love? That is, of course, unless you think the government should offer a risk free form of income, which, in my opinion, is a totally reasonable view to maintain.

¹ – See, who determines interest rates?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.