Here’s Paul Krugman confidently declaring that the Fed doesn’t even indirectly influence the broad money supply via QE:

I do think Glasner misses a point when he says that:

“the quantity of money, unlike the Fed Funds rate, is not an instrument under the direct control of the Fed.”

Actually, under current conditions — in a liquidity trap — it’s not even under the indirect control of the Fed. The same impotence of conventional monetary policy that makes open-market purchases of Treasuries useless at boosting GDP also mean that broad monetary aggregates that include deposits are largely immune to Fed influence. The Fed can stuff the banks full of reserves, but at zero rates those reserves have no incentive to go anywhere, and even if they do they can sit in safes and mattresses.

He continues:

it has always been clear, if you read my work, that I know that the Fed only truly controls the base and that this need not translate into changes in broader aggregates.

Sorry, but this is not correct. QE, when implemented through banks as intermediaries with the non-bank public (as most QE is implemented) ABSOLUTELY impacts the broad money supply. I’ve explained this hundreds of times over the years and it has nothing to do with liquidity traps and only to do with basic banking and basic accounting. Here’s the accounting:

Non-bank sells $100 in t-bonds to Fed where bank acts as intermediary

Federal Reserve balance sheet:

Change in Assets = +$100

Change in Liabilities = +$100

Change in Net Worth = $0

Banks balance sheet:

Change in Assets = +$100 (reserve assets increase)

Change in Liabilities = +$100 (deposit liabilities increase)

Change in Net Worth = $0

Non-bank public balance sheet:

Change in Assets = $0 (non-bank sells t-bond and obtains deposit)

Change in Liabilities = $0

Change in Net Worth = $0

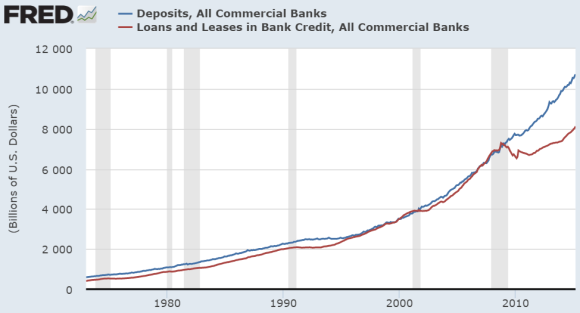

We can see this in the quantity of deposits that are outstanding. Normally, loans create deposits, but the banks have been issuing deposits as a result of QE even though loans have been very low. You can see the difference there in the quantity of loans and the quantity of deposits:

The fact that there hasn’t been high inflation has nothing to do with liquidity traps or zero bounds or anything like that. The reason why QE hasn’t created sky high inflation is because it’s an asset swap that increases the quantity of money in exchange for reducing the quantity of bonds. It’s much like swapping a savings account for a checking account and assuming that you might spend more because of this. So this isn’t like dropping money from helicopters. More like dropping money and burning bonds at the same time. And all you need to understand this is some basic banking and some basic accounting.

I was joking around on Twitter the other day about how frustrating it is to have described QE for 7 years running and to still run into the same basic mistakes. But when Nobel prize winning economists can’t get it right then I guess my expectations of the general public are WAY too high.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.