Ken Rogoff took to the WSJ yesterday to explain why the infamous Dow 36,000 prediction wasn’t wrong. He writes:

Their simple policy advice: Buy a diversified portfolio of stocks, and don’t put too much money in bonds. Over the long run, stocks offer a higher return without significantly greater risk.

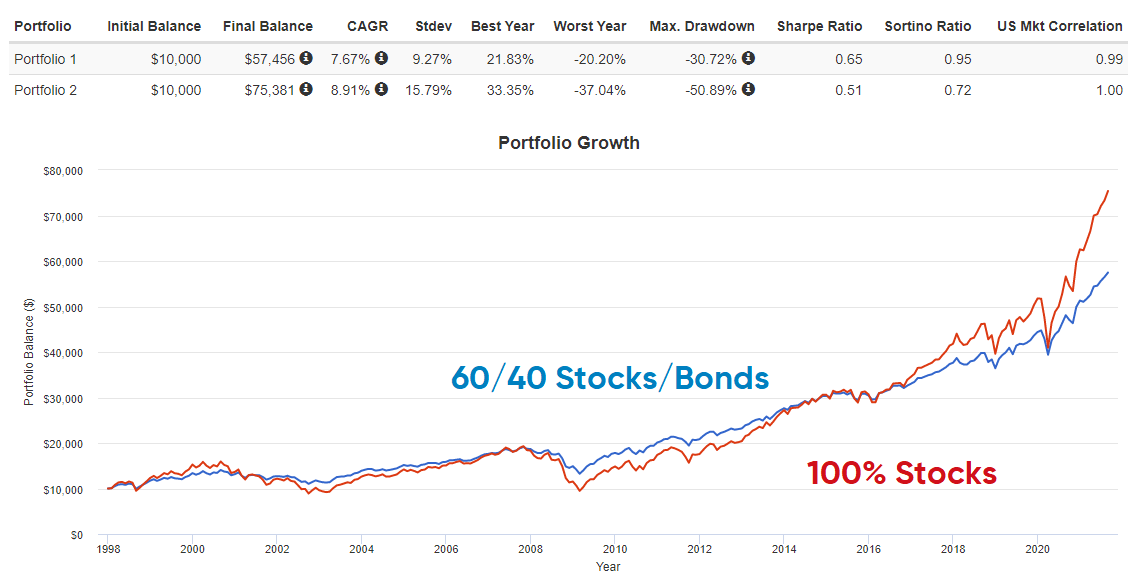

He goes on to explain that this advice was somehow correct. The problem is, if you chose not to hold bonds in 1998 you generated far worse nominal AND risk adjusted returns than a simple 60/40 portfolio. And not for a little bit – this outperformance of a 60/40 lasted for 18 years! It wasn’t until about 2017 that a 100% stock portfolio started to outperform meaningfully. And while you waited for that outperformance you endured a couple of whopping downturns including a -50% collapse. Meanwhile, your diversified stock/bond portfolio just chugged along letting you sleep better at night while generating nearly the same returns along the way.

Look, I am not here to beat people up over predictions. We all have to make predictions about the future and we’re all going to be wrong to some degree. That’s just life. But Glassman rejected one of the most fundamental and basic rules of investing – diversification¹. What he was really saying in the article was that bonds are super risky, when, it turned out that anyone buying bonds in 1998 could have generated an extremely low risk annualized return of 4.7% per year by taking the exact opposite side of the Glassman prediction. Bonds not only turned out to be low risk. They turned out to be a better choice than stocks at the time Glassman wrote the article.

But there’s the thing that really grates on me with this article – it’s exactly the kind of mentality that happens during huge stock booms that gets people into hot water. You see a stock boom and you start saying to yourself “well, why do I own cash or bonds in the first place? I should just own 100% stocks because they only go up”. And then 2001 lops you over the head. And then 2002 kicks you in the groin. And then 2008 crushes your soul and you give up on stock investing because you realize that 100% stocks is a pretty volatile way to manage your finances and then you sit in cash for a decade. I’ve literally dealt with hundreds of clients who had that nearly exact experience. And it’s reckless articles like this that lead people into that mentality. And Rogoff is doubling down on it now by arguing that bonds are again very risky. Which, maybe they are, but it’s ironic that the defense of this article comes at a time when stocks have been on a nearly unbelievable tear and should they decline, it would be bonds that prove (once again) to be low risk.

Anyhow, I am not here to beat up on anyone. I know that investing is very personal and we’re all going to get some things wrong along the way. And I am not here to say that a 100% stock portfolio might not be appropriate for you. But for anyone who has behavioral biases (hello, everyone, including this author) or needs some stability to help predict and control short-term liabilities (hello millions of retirees or near retirees) alternatives to stocks (including bonds) play a crucial role in helping you navigate that unpredictability. Perhaps more importantly, the lesson here is that we shouldn’t reject sound evidence based financial understandings (like diversification) because of behavioral or political biases. So just be careful reading articles like this in case they lead you to believe that you should take a lot more risk than you can actually stomach.

NB – I know. Interest rates are low. Bonds won’t provide the same hedge they did in 1998. That’s just math. But as I’ve explained in detail, low rates do not mean bonds can’t still serve as a meaningful hedge to a stock portfolio.

NB 2 – Thanks to Cliff Asness who sent me this link to his wonderful takedown of this article.

¹ – It’s actually worse than just a mere rejection of broad asset class diversification. Glassman implied that you can diversify inside of the stock market which is wildly misleading. When the stock market declines it becomes very highly intercorrelated. Unless you can somehow pick the handful of stocks that rise during periods like 2008 the strong likelihood is that you’re going to experience large declines since all corporations suffer during large recessions. The primary way to get uncorrelated protection is to own true alternatives like high quality bonds, insurance, etc.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.