Evan Soltas asked a question that I find increasingly common in economic circles and also odd. He’s wondering why we should think fiscal policy matters if the budget deficit has shrunk so substantially in recent years:

“It’s pretty easy to see how you might have expected a second recession with that amount of contraction. Which raises a question. Someone explain to me how the level of fiscal contraction we’re seeing is at all consistent with the view that fiscal policy matters a lot at the zero lower bound. The last year of data would suggest that the fiscal multiplier can’t be very large at all, right?”

“It’s pretty easy to see how you might have expected a second recession with that amount of contraction.” I actually don’t see why that’s “pretty easy to see”. If the private sector were causing the deficit decline as a result of higher growth and higher tax receipts then a rapidly shrinking deficit would actually be consistent with a growing economy. Maybe, just maybe, organic private sector growth is increasingly steering the economy and government policy isn’t driving the bus here. Call me crazy I guess. Okay, I am exceeding my snark limits here. But seriously, we enter a crisis in which government policy was an extremely important crutch that helped us get back to walking again and we all seem to have forgotten that our legs aren’t broken permanently….

Anyhow, the reason why the deficit didn’t cause a recession is due to the reasoning that I’ve been explaining for years now. I’ve been a fiscalist for years now and at the same time I’ve been saying there would be no recession in 2010, 2011, 2012, 2013. Why? Well, the credit crisis caused an extraordinary economic collapse which required public sector aid. And monetary and fiscal policy helped get private balance sheets back to normalcy. And now the private sector is increasingly running with the baton. We’re not running full speed, but we seem to be moving at a slow jog.

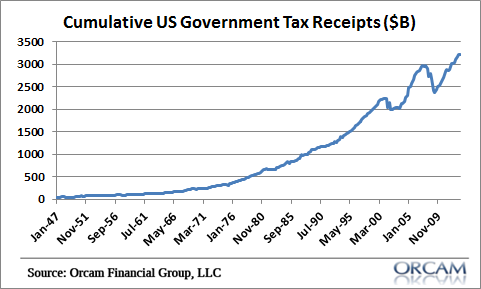

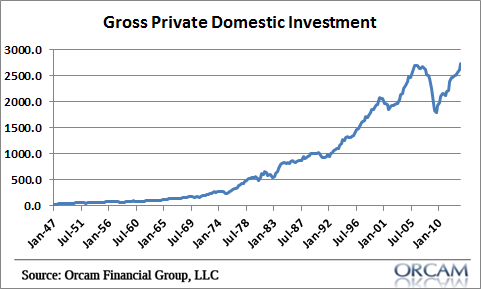

So, the reduced deficit is neither a sign of austerity nor a driver of necessary private sector collapse. And it’s certainly not a sign that fiscal policy can’t be effective at all. Instead, the shrinking deficit in recent years has been due to higher tax receipts as a result of a vastly improved and increasingly organic private sector expansion. Don’t trust me?

See tax receipts at an all-time high:

Or how about gross private domestic investment at an all-time high:

This looks totally normal to me. The deficit expands during a shock as automatic stabilizers kick into gear and then the deficit shrinks as the private sector recovers and tax receipts drive the deficit lower. It doesn’t mean fiscal policy didn’t work to help us get out of the crisis. It doesn’t mean there’s been austerity. All it seems to show is that economists seem to get so honed in on their various policy ideas that they sometimes forget that there’s a whole big part of the economy out there operating without a care in the world for things like NGDP targeting, the latest Fed blathering, or how many t-bonds were issued last month….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.