Tyler Cowen has a piece in the NY Times from this past weekend discussing the potential that the US economy will never return to “normal”. The article implies that the US economy could be in the middle of a “great reset” during which the future looks quite “grim”. But there’s a potentially substantial problem in such thinking – what is “normal” and why must the economy return to this previous state of normalcy?

When we think about the economy we tend to think about a system moving in big cycles tending to revert to some long-term trend. So, when we undergo a recession we tend to assume that the economy is going to reset and then return to its previous trend. But what if this sort of thinking is little more than a form of recency bias and extrapolative expectations? What if the economy has no tendency to revert to past growth rates and instead moves in a series of fluctuations that are dependent more on future developments than past developments? If that’s true then there is no “normal”. There is only a series of “new normals” that are always developing inside of the economy as it evolves with time.

An analogy for this thinking might be an animal evolving across millions of years in different environments. This animal does not experience some linear trend in its development over time. It evolves and adapts to changing conditions. If the Earth’s atmosphere becomes colder it might develop a heavier coat of hair. This dynamic shift in the animal’s appearance is not just an extrapolation of past evolutionary trends, but is the result of adapting to a dynamic new normal. The economy, though operating in much shorter time frames, is probably not that different.

A more apt comparison for regular readers is the concept of “beauty”. In our lives the concept of “beauty” is extremely dynamic. What’s beautiful to one generation is not so beautiful to another. Likewise, in the financial markets, a beautiful stock market in one era might look quite ugly to another set of investors in a different era. Just look at the seemingly permanent high state of valuations for evidence of this. Perhaps the idea of economic “normalcy” is just as dynamic?

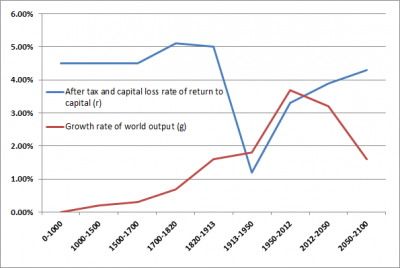

To put this in some historical context we can look at the growth of the economy over the course of the last few thousand years. As Thomas Piketty has noted, global growth has tended to be far lower than the 3%+ rate that most of us are accustomed to:

(Red line shows average annual global growth rate)

(Red line shows average annual global growth rate)

Since the 1750’s the average annual growth rate has been just 2.4%. So, if our “normal” historical benchmark is 2.4% then maybe the current average growth rate of this recovery, at 2.2%, isn’t all that bad? But 2.4% is hardly “normal”. It’s just an average inside of what has been an extremely dynamic shift in economic growth. More importantly, there’s really nothing “normal” about 3%+ growth. In fact, it’s the exception and not the rule in the post-industrial economy.

In addition, as I showed recently, our recoveries are actually becoming longer and far less volatile which actually means that they’re becoming higher quality recoveries. While our growth rate is lower our quality of growth actually appears to be improving. So you can’t just look at nominal growth figures and assign some idea of “normal” to each economic cycle.

It all makes me wonder – maybe this “new normal” isn’t so abnormal or bad after all. In fact, maybe it’s just not “normal” to have Nasdaq bubbles and housing bubbles that create a high level of artificial growth in the short-term that ultimately end up causing a bust later on? Maybe it’s just not normal to have 30 years of stimulative declining interest rates? Maybe this low and boring growth is just a new normal that really isn’t so bad after all? And maybe new normals are the actual normal state of economic development.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.