When Robo Advisors first came on the scene they differentiated themselves by claiming to be fiduciaries who didn’t have all the conflicts of interest that Wall Street had. They were right. But they were also wrong in thinking that this was a sustainable business model. In 2015 I wrote a series of posts critiquing these services (see here and here):

“The smaller Robos are in a branding bind here. They are hesitant to adopt their own ETFs because then they begin to blur the lines on being fiduciaries. It’s highly unlikely that their ETFs would command the same low fees as the same ETFs at Schwab or Vanguard (due to sheer scale). And they don’t want to become banks because then they look like the brand they are trying to differentiate themselves from. In essence, in order to survive these FinTech firms are going to have to become some version of old Wall Street. They must adopt their own ETFs, become banks or offer more traditional advisory services.”

Since then these firms have done all of the above. WealthFront, one of the leading Robos has adopted the portfolio line of credit (a banking service) and recently started their own mutual fund, the WealthFront Risk Parity Mutual Fund.

Now, I like WealthFront and I think these low cost robos are very valuable to certain customers so I don’t want that to be lost in the scope of this conversation. Their low cost passive service is infinitely better than what you get at most of the big brokerage firms. But this move to a Risk Parity fund is really confusing for the following reasons:

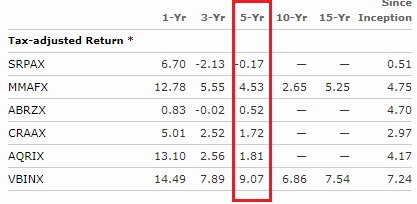

- Risk Parity mutual funds kind of suck. Although I like the concept of Risk Parity I’ve been really disappointed with the implentation and performance of the actual funds. Below are the leading Risk Parity funds compared to Vanguard’s Balanced Index (60/40). The one consistent time horizon after taxes and fees displays massive underperformance:

- This could incur a taxable event and will definitely increase fees. WealthFront will swap 20% of your account into this strategy thereby resulting in a taxable event and an increase in your fees.

- Bye bye fiduriaries! WealthFront can no longer claim to be acting as a pure fiduciary since they are now utilizing their own higher fee funds.

- Why move to active when your brand is passive? Now, regulars know that I hate the term passive investing (it’s not a real thing), but Risk Parity is definitely an active higher fee strategy. So it’s strange that they’re a firm based on the low cost passive investing movement and trying to claim this is a passive strategy, which it most definitely is not.

I don’t know what’s going on here. My guess is that the venture capitalists are getting concerned about their revenue growth and this is a pretty quick way to generate immediate higher revenues. But it looks like a raw deal for the customers. Luckily, you can opt out of the strategy and stick with the plain vanilla low cost ETF structure that they already have in place. Unfortunately, a lot of people won’t do that and I suspect they’ll deeply regret it in the future.

NB – For the uninitiated – Risk Parity is a strategy that tries to balance where the risk exposures in your portfolio are coming from. Since stocks are generally more risky they expose investors to more risk than bonds do. So, for instance, a 50/50 portfolio of stocks and bonds isn’t really exposing you to equal weighted risk. The stock piece is driving most of the risk in the portfolio. Better balancing this risk is a smart way to manage risk in a portfolio, but there are infinite numbers of ways to implement such a strategy and I can’t say that I love most of what I’ve seen so far from the publicly available fund community. It’s hard to see how this new fund will be different.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.