Back in 2008 Warren Buffett made a famous bet with a big hedge fund.¹ Buffett bet that the S&P 500 would outperform a fund of hedge funds over the next 10 year period. His basic thinking was that most investors are better off owning a low cost index fund rather than owning high cost stock picking funds. And so far, Buffett is winning the bet by a mile with a total return of 65.67% for the S&P 500 vs 21.87% for the hedge funds.²

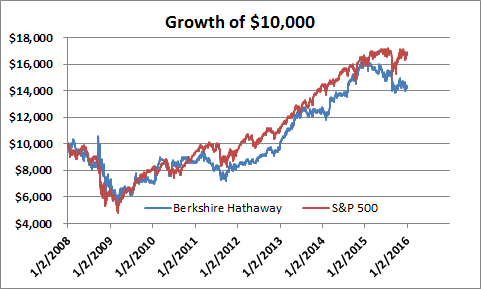

But there’s another inconvenient truth within this bet – Buffett isn’t really winning this bet. After all, his own company, Berkshire Hathaway, which is essentially an actively managed portfolio of public and private companies, is also losing out to the S&P 500. Since the beginning of 2008 Berkshire has underperformed the S&P 500 by 24.5% as of the start of 2016.³ This is better than the margin the hedge funds are losing by, but still doesn’t bode well for Berkshire.

Fortunately for Buffett the news has improved a bit since the start of the year. He’s now down just 18.06% vs the S&P 500. But will the momentum be enough to take him through next year? 18% is an awful lot to make up, but if anyone can do it we’d expect Buffett to be the guy….

¹ – The exact terms of the bet are:

“Over a ten-year period commencing on January 1, 2008, and ending on December 31, 2017, the S&P 500 will outperform a portfolio of funds of hedge funds, when performance is measured on a basis net of fees, costs and expenses.”

² – These returns are as of 12/31/2015.

³ – Returns are measured with dividends reinvested in the S&P 500.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.