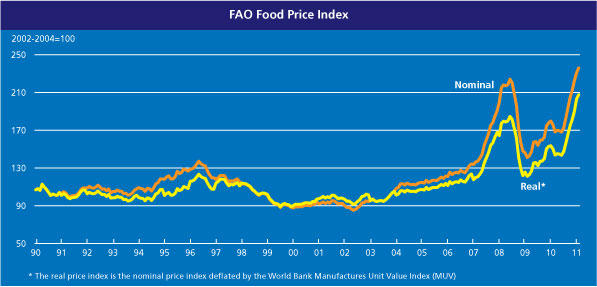

Shades of 2008 in this data….As we see housing prices continue to slide, food and energy prices are surging and eating into consumer spending. The following chart shows the food price index over the last 20 years. As you can see, prices are now above their 2008 highs:

While we’re seeing some marginal signs of cost push inflation the impact is not yet blunting consumer spending as it largely transfers spending from discretionary to these non-discretionary items. As David Rosenberg notes, the crunch is on:

“As we explain below, the outlook for the U.S. consumer is grim. Much of the payroll tax cut is now being absorbed by higher food and energy costs (gasoline prices have jumped more than 50 cents this year). In fact, over the past three months, 100% of the $55 billion increase in aggregate wages and salaries has been absorbed by the run-up in the grocery and gasoline bill. The labour market is not nearly as strong as it needs to be to provide the antidote, and at the same time fiscal policy is swinging from massive stimulus to moderate restraint (have a look at U.S. Muni Bond Demand Slides Into Deep Freeze — local levels of government are not able to raise money and as such are cancelling capital projects … sad but true… and outside of the consumer, this sector is the largest contributor to GDP). Also have a look at Michigan Cuts Jobless Benefit By Six Weeks on the front page of today’s NYT.

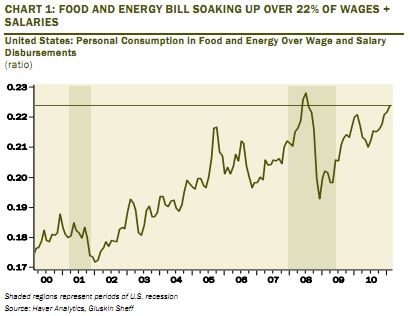

As the chart below shows vividly, over 22% of wages and salaries are now being devoted to the cash register at the local food store and at the pumps — we’ve only seen this level two other times in the past two decades and both ultimately landed the economy into recessions that ensnared discretionary household spending. The good news — a new bull market in frugality, ‘trade down’ goods and private label is likely on its way again. “

I am far from calling a repeat of 2008 (the environment is very different given the lack of the size in the debt bubble), however, the likelihood of a booming economy given these conditions is unlikely. More likely, we see stagnant job growth as producers protect margins and relatively stagnant consumer spending. For now, the sizable budget deficit is helping to bolster the economy. The one risk the USA does not control is overseas strength and the bubble in food prices is putting a significant strain on emerging market economies. Will it be enough to break the US economy? For now, China appears to be hanging in there just fine, but the disequilibrium certainly warrants some caution regarding economic growth in H2. We likely won’t see markets price this risk in until closer to the end of QE2….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.