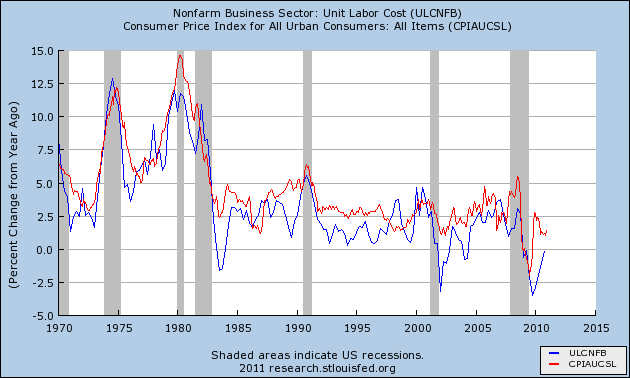

The following is a very similar chart to the one I have often posted on disposable income:CPI. It clearly shows that there is a very high correlation between inflation and labor costs in the USA. Of course, labor costs are the largest cost input for US corporations. Higher labor costs coincide with higher wages. That situation would tend to coincide with relatively robust economic growth. While we’re seeing income growth and modest economic growth the situation is certainly not consistent with high levels of inflation as the labor market remains very weak.

Barry Ritholtz notes that this is likely to result in margin compression as opposed to much higher levels of core inflation:

“These indicators had a high correlation — 0.82 during the period — according to Brian Belski, chief investment strategist for Oppenheimer & Co. Labor costs have fallen for the past eight quarters, and are essentially flat over the past decade. Declining wages means consumers have less cash to fuel spending. Companies will have a limited ability to raise prices, and will likely see their margins pressured, Belski has argued.

Hence, even rising bond yields are unlikely to reflect a worsening inflation outlook. Since October 7th 2010, the yield on the Treasury’s 10-year note climbed 1.25 percentage points from its low.”

Corporations aren’t the only ones seeing compression. This morning’s retail sales report confirms that this view is also consistent at the consumer level as we see consumers spending more and more on gasoline and food and less on other items. The commodity price surge is very similar to 2008. On the surface it looks like inflation is raging, but beneath the surface lies the continuing deflationary forces that have been intact for several years now. The relative strength in the economy is enough to generate modest inflation, however, it is not enough to generate very high inflation – not unless we see a boom in the job’s market.

For now, it is clear that most of the inflation is not arising from the USA where end demand is still very tame. Although one can make an argument that the Fed is fueling commodity speculation (which is likely unsustainable), the only real evidence of surging commodity demand and “money printing” is in China where their money supply has exploded. The inflationistas have thoroughly misinterpreted a hyperinflationary collapse in productivity with a modest inflation acceleration due to meager economic growth in the USA. That’s right, the USA, $USD and US bond market did not collapse into a hole like they all predicted it would. But it’s not necessarily great news – unfortunately for Americans the commodity surge means less to spend on other items. That new McMansion might have to wait….On second thought, that might not be such a bad thing. The last thing we really need right now is a mass re-leveraging of the household sector.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.