Here are some things I think I am thinking about:

1) Q2 GDP – More bleh than expected. For all the talk about how great the Q2 GDP was going to be I have to say that I wasn’t really that impressed. The year over year rate comes in at 2.8% which is not really that impressive. Prices were up some, but at 2.7% we’re pretty consistent with the core readings we’ve seen in recent CPI. Private residential fixed investment was up 7.5% year over year which is pretty consistent with what we’ve seen for years. So…this isn’t bad and it isn’t great. It’s really just more of the same.

2) Cracks in Housing? It’s pretty hard to find anything in the economy that’s too bearish. After all, most of the big trends that have been in place for the last 10 years are still in place. But if you squint enough you’ll find a bit of weakness in housing data.

My general theory of how the economy works is pretty simple – we pretty much spend money at a rate that is consistent with incremental increases in annual needs/wants. That spending drives a certain degree of growth. Sometimes we overreact on the upside about certain things and that spending increases at a higher than normal rate. When the euphoria driving that spending slows we get an economic downturn or a recession.

If you subscribe to that general theory and also believe in the theory that “housing is the business cycle” then big asset price booms in the real estate market are pretty worrisome. So it’s interesting now, after a pretty big boom in housing that we’re seeing prices hit a bit of a wall. And as price increases slow we’re seeing overall activity slow. This week we got data on:

- New home sales: -5.3%

- Existing home sales: -2.2%

It’s nothing to freak out about, but certainly worth keeping an eye on.

3) So. Many. Bad. Narratives.

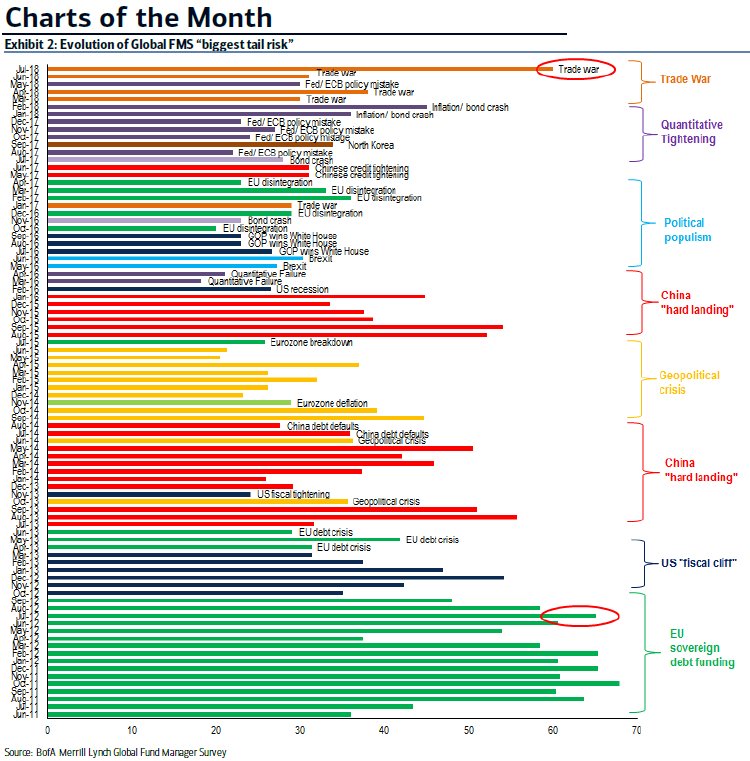

Here’s a chart from Merrill Lynch that had me laughing. It shows the fund manager’s survey result for the biggest tail risk:

It’s like a trip down memory lane of all the things that were supposed to derail the bull market and didn’t. My personal favorites are “fiscal cliff” and “bond crash”.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.