Here are some things I think I am thinking about:

1. Bernie Sanders does economics…. Here’s a very strange Tweet from Bernie Sanders showing that even potential leaders of the USA don’t need to understand economics 101:

It makes no sense that students and their parents pay higher interest rates for college than they pay for car loans or housing mortgages.

— Bernie Sanders (@BernieSanders) October 15, 2015

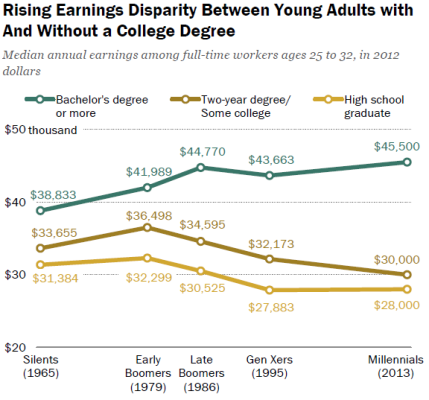

Yikes. Actually, it makes perfectly good sense that a borrower with no collateral and no income pays a higher interest rate than most auto or home buyers. In fact, it doesn’t make sense that someone with no income and no collateral can even get a loan. But the government ensures that going to college , which is actually a wonderful investment, is an option for zero creditworthy borrowers. As Pew Research has detailed in excruciating detail, the biggest cost in one’s life might just be NOT going to college.

, which is actually a wonderful investment, is an option for zero creditworthy borrowers. As Pew Research has detailed in excruciating detail, the biggest cost in one’s life might just be NOT going to college.

This isn’t the point I am so concerned with though. The payoff of college is a pretty granular discussion and one that can’t really be generalized. But what’s concerning here, for me, is that political candidates seem to lack basic monetary knowledge and worse, will intentionally misconstrue important points just to gain favor with potential voters. Either way, it doesn’t seem good to me.

2. No. Make it Stop. Not the debt ceiling again. The US Treasury is about to run out of money again. Well, not really. This entity can sell bonds at 0% interest rates so they literally cannot “run out of money”. But Congress is basically telling them they aren’t allowed to sell those bonds at 0%. Which is really weird because Congress is the entity that voted to allow the spending that resulted in Treasury needing to sell bonds in the first place. As I’ve described in the past, it’s as if I ate a whole pizza and then tied a knot in my intestine and threatened my stomach not to digest that pizza: “don’t you even think about digesting that food I already ate!”. Yeah, that’s not really how that works.

Anyhow, this charade has gotten old. And I have a feeling it’s why America is clamoring for people who aren’t lifelong politicians. It’s becoming clear that politicians are good at getting nothing done while keeping their jobs. And this whole fiction surrounding the debt ceiling is just another sign of the toxic waste that has been building up in Washington for so long. At this rate, we might have a Congress filled with Donald Trumps in a few years. And if that’s the case we’ll have to all avoid the aforementioned pizza and watch our waist lines a little closer so as to avoid being called “fat pigs” on a regular basis by our Trumpian overlords.

3. Will We Get a “Santa Claus Rally”? Well, it is starting to look like the “world is ending” crowd was wrong again. Stocks are off to a blistering start in Q4 and are up 9% from the August lows. The S&P 500 is just 5% below its all-time high. And now we have the seasonal effect coming into play. Now, I usually don’t put much credence in these seasonal factors, but the 4th quarter is a weird time because it’s when asset managers start to feel job risk. So, there’s a tendency in Q4 for asset managers who are performing poorly (usually most of them relative to broad benchmarks) to chase returns and use every dip to buy risk.

2015 is a year when this impact might be even more exaggerated because of the level of uncertainty coming off the China scare. For a brief moment it looked like China was going to pull everything into the depths of hell, but as more and more data comes out it looks like more of the same that we’ve been seeing for years – sluggish, but not catastrophic growth. As I’ve stated in the past, it all looks so much like the 1998 scare….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.