I have been thinking about some stuff lately and I’d like to share with the group:

1 – Howard Marks on the Everything Bubble. Here’s a typically good memo from Howard Marks. This is a pretty good summary:

Just kidding. Kind of. The memo does read a bit like an angry old man screaming from his porch. Which is fine, because, isn’t this what all young men aspire to be when they’re old – someone who sits in a rocking chair with a shotgun protecting your hoard of assets while waiting to tell some young punks how to live their lives? If you’ve achieved that then you’ve basically won at life, right?

I don’t know if Marks is right that just about everything is a bubble. The word “bubble” is a tricky term and I personally don’t buy the idea that everything is in a bubble. For instance, if stocks crater from here then long duration government bonds will almost certainly surge. Weird, eh? The asset that almost everyone hates is the one that you should love if you hate everything. We’ve seen that time and time again and it’s a function of a simple fact – when it comes to the hierarchy of financial assets the US government’s bonds are the safe asset because the US government is the highest income generating entity in the financial system. So, in a closed system where all financial assets are always held there literally cannot be a bubble in everything because something in the pool of assets will get bid up as a result of everyone passing the hot potato along until there’s one thing everyone wants to hold. And this isn’t just some inane theory I came up with thinking about macro stuff. It’s backed by the performance history of the last few big bear markets when long duration T-Bonds generated double digit returns as the stock market sank.

So, when someone says everything is in a bubble I think there’s good reason to question whether they’re using a macro consistent framework of the world. In this case, I suspect Marks is just talking his book as he’s probably overweight safe assets and is licking his chops to see high quality assets become low quality assets when they’re really high quality assets. But that’s just a guess….

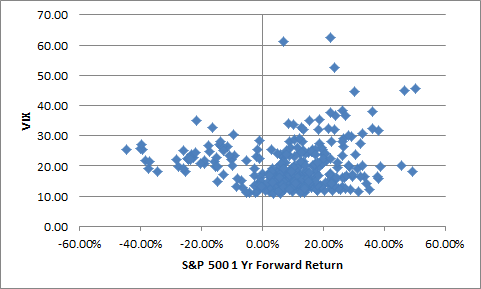

2 – Cliff Asness Wants you to Shut Up About the VIX. Here’s a good memo from Asness on the VIX. Cliff basically proves that the VIX is nothing more than recent realized volatility. He goes on to say that this isn’t a very useful gauge of “fear” despite its moniker. I’ve said the same thing repeatedly over the years. But here’s something even more interesting. I took the one year forward returns relative to current VIX readings and found that the forward returns actually tend to be positive when the VIX is low:

That’s not really surprising since the S&P has a strong positive skew on average. And as I’ve stated in the past, a short-term indicator of sentiment is not going to tell you anything about the future returns of an inherently long-term instrument like the stock market. So I guess I am with Cliff on this in saying that you should really stop worrying about a low VIX. It’s not saying what the fear based narrative says it says.

3 – Robo Advisors are not Advisors. Here’s Josh with a good piece on Robo Advisors. Josh hates the term “robo advisor” about as much as I hate the term “passive investing”. And he has good reason. Robo Advisors aren’t really robotic advisors. They’re just automated investment services that are implemented and managed by human beings. And the more successful ones have teamed up with humans to provide the actual advisory service using real humans. But we should be even clearer about this. The actual asset management side of a Robo Advisor is just an investment product. They’re an automated way to own a tax efficient low fee set of index funds. Those index funds will be allocated according to how the Robo picks them. Some firms like Smart Beta, others like less active approaches. But at the end of the day you’re essentially paying a fee for the convenience of an automated investment product.

All of this has to leave you wondering – if a Vanguard LifeStrategy fund or a Target Date fund is already doing all the automation for you and you aren’t using a human advisory service along with the Robo service then why would you own a Robo service at all? As I’ve shown in the past, most of the Robo Advisors are just target date mutual funds with extra fees. So it all kind of begs the question – if you aren’t using the human advisory side of a robo then what are they bringing to the table that existing services don’t already do? In other words, if it’s just a pure “robo” then why should anyone bother to pay extra fees for it when these investment products already exist in what is actually a simpler form?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.