I’m thinking mostly about the war in Ukraine, but here’s some other stuff to distract you (although this will be mostly about the war in Ukraine, sorry).

1) The limits of government solvency.

So much to say about the Russian invasion of Ukraine. Honestly, it has me pretty depressed. Maybe it’s just being a new dad and worrying about the world my daughter’s will grow up in. I’m not sure. I’m usually a very optimistic person, but I think Putin has lost his marbles and I don’t see how this ends well unless there’s a coup that overthrows him. And maybe that’s the optimistic case here. After all, the economic situation in Russia is truly catastrophic and  there’s no way Putin expected this. Some of the economic data here is unbelievable. In a matter of days the Ruble has collapsed over 25% vs the Dollar and the Russian stock market, while closed, is trading down 70% in other markets.

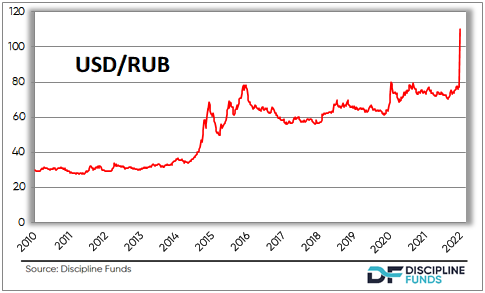

there’s no way Putin expected this. Some of the economic data here is unbelievable. In a matter of days the Ruble has collapsed over 25% vs the Dollar and the Russian stock market, while closed, is trading down 70% in other markets.

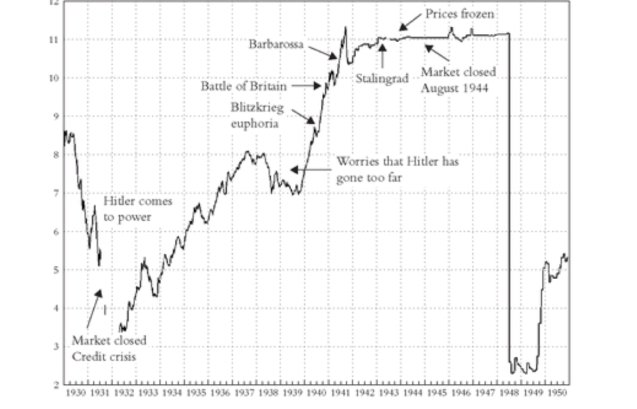

Perhaps the most interesting historical corollary here is Germany during WW2. Although Russia isn’t Germany it’s probably the most similar situation in recent history. But the fascinating thing about Germany in the 1940s is that the economy boomed and the stock market soared. Below is a chart from Barton Biggs’s interesting book “Wealth, War and Wisdom”. It shows the stock market boom in Germany as the war progressed and industrial production in Germany soared. Then it all came to a screeching halt as it became clear that Germany would lose the war.

There’s no way of knowing what’s going on in Putin’s scrambled brain at this point, but perhaps he thought it would be economically beneficial to take back this resource rich country? But it looks like he has massively overplayed his hand here. The swift impact of global sanctions is decimating the Russian economy. How long can they afford to engage in this costly war?

It will be an interesting thing to consider going forward. Russia seemed to be doing all the right stuff in the years leading up to this, but their financial position has become untenable in just a matter of weeks. How will they respond? Will they print like war torn countries often do? Will that exacerbate a high inflation and cause hyperinflation like it usually does? I think we’re about to find out that even an entity with a printing press runs into a very real financial constraint when things go against them.

2) Nails are complex!

Here’s distraction from the WW3 talk to something that is really fascinating – NAILS. Yes, nails. The thing you hit with a hammer. This is close to my heart as I became very intimate with nails over the last few years as I built my house. You’d be amazed at how many different types of nails there are and how complex and advanced they are. From framing nails to deck nails to roofing nails to siding nails, etc etc. They come in all shapes, sizes, textures and materials. They can be made so you hit them with a hammer, you shoot them from a gun or you sink them with a puncher. Who knew nails were so complex?

It’s even more interesting when you consider nails in the context of historical inflation. And here’s a new paper that goes into the topic in detail. Here we have a consumer good that seems quite simple. Except it’s not at all. And as technology has advanced a very simple item has become an incredibly complex one. So, imagine being the person (or entity) that tries to create a measure of how the price of that item has changed over time and how it applies to consumer price changes? It’s frigging impossible! And that’s just one common household item. Imagine trying to do this for thousands of household items.

Some people read my work and think I am a Fed apologist or CPI apologist. But that’s not really the case. It’s just that I read papers like this talking about a seemingly simple item and it becomes clear that measuring inflation has to be one of the most difficult statistical endeavors the government engages in. Do they get things wrong? Of course. How can they get it perfect?

3) When markets break.

Dave Nadig had a great piece about the Russian stock market and the ETFs that track it. In short, the Russian market is closed, but Russian ETFs are still giving investors an imperfect form of access to the market. This is the double edged sword of ETFs. On the one hand, they provide you with daily intra-day liquidity, but on the other hand, that liquidity is going to be imperfect at times. You have to really understand the waters you’re wading into here and how the instrument works. Otherwise you’re prone to make mistakes that investors shouldn’t make. This is why John Bogle always disliked ETFs – he thought they encouraged gambling in markets using a structure that is much more appropriate for long-term passive oriented investing than short-term trading. And while I understand Bogle’s critique I think he was wrong. Sure, people will always misuse certain tools, but as the old NRA saying goes, “ETFs don’t kill people, people kill people”. Not exactly an appropriate quote given the current circumstances, but hey, I’m trying to lighten the mood over here.

Anyhow, Dave’s piece is a good one and worth a read as it teaches you a lot about the market structure of ETFs and markets more generally.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.