Here are some things I think I am thinking about.

1) Should We Get Awards Just for Participating? James Harrison made headlines this past weekend when he said his kids would be returning their “participation trophies”. I have to say that I don’t understand this trend in giving people an award just for showing up. Maybe I am too old school or something, but athletics, to me, is inherently competitive. Just like academic work prepares one for the mental competition of school, athletics prepares one for the physical competition we will encounter through parts of life. We don’t give kids A’s just for going to school and trying their best. So why would we give them trophies just for showing up to play sports? Competitive sports serve a specific function just like competitive academics. If we don’t want kids participating in socialized events like sporting events then can’t they learn to socialize without the competitive part (there are countless other options after all)?

I know, I know. There’s some logic behind participation trophies. We want kids to feel included, learn to socialize and avoid some of the bullying mentality that tends to coincide with competition. But when did it become impossible to teach children to have fun, play with sportsmanship AND be competitive?

This kind of reminds me of the whole discussion about capitalism today. Some people think capitalists have to be these cruel and cutthroat profit hoarding maniacs who take more than they give. But that’s just not true. The best capitalists earn a profit precisely because they give so much to the world. There is no reason why capitalism can’t be synonymous with giving. In the same way, competitive sports can be synonymous with sportsmanship. But that depends on what type of athletes and capitalists we decide to raise.

2) Donald Trump said something extremely wise on Twitter yesterday:

When foreigners attend our great colleges & want to stay in the U.S., they should not be thrown out of our country.

— Donald J. Trump (@realDonaldTrump) August 18, 2015

This one always confounded me. Why would we invite foreigners in to benefit from our schools and then kick them out? It’s almost like we want to invest time and money in the world’s most valuable assets (humans) and then not benefit from those investments. It just makes no sense. How in the world has this law not been changed yet? Congress, just do it!

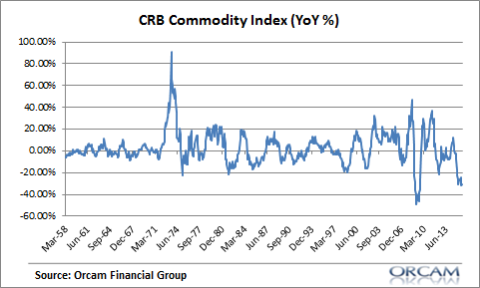

3) The Relentless Commodity Crash. Earlier this year I mentioned that commodities were becoming more attractive. This has been a fairly big change in my view as I’ve been bearish on commodities for as long as I can remember. That looks pretty silly in the near-term as commodities have fallen another 15% this year. But this isn’t a trading view. It’s a cyclical view. Here’s a good perspective on how unusual this current downturn is:

As Vanguard has noted, commodities have generated 22% annualized returns in late market cycles. This isn’t just some trading guess either. The rationale is quite logical. As the business cycle matures and wages rise we also tend to get rate increases and a rise in inflation. So commodities get bid up.

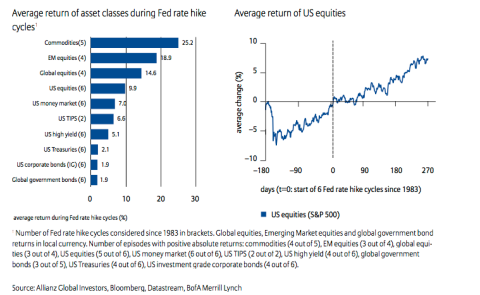

Here’s another view of this via Allianz – the average return of different asset classes during Fed rate hikes. We hear a lot of chatter about how US stocks perform poorly during rate hikes, but this just isn’t true. And this makes sense. The reason the Fed raises rates is precisely because the economy is improving so it makes sense that interest rate increases would positively correlate with stock market increases. But take a look at that commodity return. It’s almost three times better than the average US stock return during rate hikes.

Of course, we shouldn’t go overboard with this view. As I’ve noted before – commodities have ALMOST no place in your portfolio. Commodities are not cash flow generating instruments that we should build portfolios around. But the arithmetic of future returns isn’t very kind to stocks and bonds and if we can buy commodities at multi-decade lows in a late market cycle environment then they might just contribute positively to portfolios during a time period when a lot of other assets just don’t do that well.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.