Here are some things I think I am thinking about….

1) The Investment Strategies of Famous Economists. I am always curious about how economists actually practice what they preach. After all, the nexus of finance and economics says a lot about how effective an economist’s ideas might actually be in reality. I’m not technically a trained economist, but my own economic theories match very well with my own practical investing application. That is, I am a macro type thinker who believes that the markets get things more right than wrong, but that the efficient market hypothesis is dreadfully wrong at times which leaves room for discretionary intervention in the markets on occasion. This translates to – I am a low fee diversified indexer who deviates from market cap weighting.

I got to thinking about this when JP Koning posted a paper on Twitter discussing Ben Graham’s monetary views. Specifically, Graham was a proponent of using a commodity reserve currency system. Graham wasn’t an economist, but his ideas spurred a lot of response from famous economists like Keynes, Hayek and Friedman. And as one might expect from his value investing approach he was fully in favor of discretionary market intervention.

Graham’s reserve commodity system was the value investor version of targeting a price level in the commodity markets. That is, he advocated that governments should buy commodities when their price falls below intrinsic value and sell when their prices rise above intrinsic value. This would smooth commodity price volatility and act as a natural stabilizer of the price level.

I could write a whole book on the various investing approaches of famous economists ranging from the discretionary asset picking of JM Keynes (who was apparently quite good at it) to the efficient market views of someone like Milton Friedman who would have loved today’s modern “passive” indexing mentality. So maybe I’ll have to circle back to this topic when I have some more time.

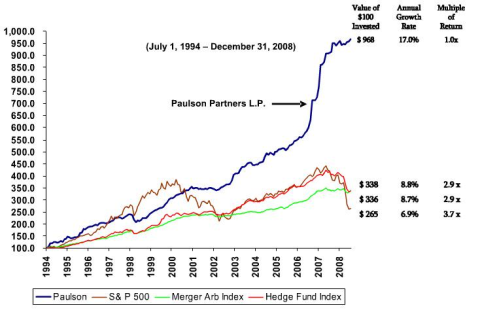

2) Merrill Pulls Money From a Famous Hedge Fund, Again. Speaking of investment strategies. Did you hear about Merrill Lynch pulling money from a John Paulson hedge fund? This reminded me of my days at Merrill. We used to have access to this JW Henry hedge fund. It cost a boatload to own and I researched the heck out of the thing. But I could never figure out how it worked so I never actually used it. The fund burned out and Merrill removed it from the platform a few years after starting it. It was one of those cool sounding “alternative” products that marketed the “guru” investor’s past performance. Sounded great in theory, but was a total dud in reality.

There’s a good lesson in this. Investors and investment managers are always looking for something fancy and cool sounding. And who could turn down this:

Merrill cited illiquid investments and volatility as their reason for the redemption:

“regarding significant concentration in illiquid investments, as well as heightened volatility and risk profile for the funds,”

In other words, poor performance and lock up periods. They didn’t cite high fees of course. But that’s the real lesson here. A lot of people in this business will try to sell you a Ferrari (or what looks like a Ferrari) when all you really need is a Honda Accord. Worse, too many of these Ferraris turn out to be Pintos that you paid a Ferrari price tag to own.

3) John Stewart burns Wall Street. Here’s a fun video for the final day of John Stewart’s show. Stewart was a master of oversimplifying Wall Street’s periodic troubles in hilarious skits. I am not sure who will pick up the slack now that he’s done, but someone has to do it because Wall Street is an inevitable sh*t show every now and then. Anyhow, watch his sickest Wall Street burns.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.