Here are some things I think I am thinking about:

1) MACRO IS USELESS! NO, MACRO IS GREAT!

The most recent Howard Marks memo is a real rollercoaster of macro emotion. He starts off by declaring that macroeconomics is useless. But then spends 15 pages explaining some of his macro views and why they might be important. It’s easy to hate on macroeconomists. They didn’t predict the financial crisis and they pretty much don’t predict anything at all. But I think this is a misinterpretation of why macroeconomics is useful. Macro isn’t useful because it can provide you with very precise and timely predictions. Macro is useful because it gives you a general framework for navigating the world.

I like to think of macroeconomics and macro finance like dieting. I am not a dieting guru. But I rely on understanding a macro understanding of dieting to help me maintain a healthy diet. I don’t need to predict when my body will crash from specific nutrient deficiencies. But I do like to know that eating a certain quantity of X, Y, Z foods will help me maintain a generally healthy lifestyle. My diet isn’t going to turn me into some sexy male model, but having a general framework will provide me with a framework that help me better achieve certain goals. Or, more succinctly, it provides you with a framework that helps you avoid catastrophic mistakes.

Having a macroeconomic and macro financial framework is exactly the same. For instance, perhaps you believe, like Howard Marks does, that forecasting the future is futile. Personally, I’d argue that everyone has to make some degree of forecasts, but as a general rule it’s okay to declare that you think the market will be right and that you therefore just want to allocate assets according to something like a truly passive asset allocation such as the Global Financial Asset Portfolio. Well, congrats. You just applied the most macro based strategy possible – passive indexing! And passive indexing has been fabulously successful because it applies simple macro rules that are generally right including:

- Control your frictions (taxes and fees)

- Diversify broadly

- Don’t time the market

All of these macro concepts are general rules that provide a broad framework for success. Yes, they won’t turn you into Warren Buffett, but they increase the odds that you’ll achieve your financial goals. It’s not about being precisely right so much as it’s ensuring that you won’t end up being precisely wrong. To me, that’s what macro is all about.

Anyhow, I think a lot of people get into trouble with macro because they think it will give them some sort of super power that enables them to trade interest rate swaps around Fed decisions or some nonsense like that. But the reality is that macro is useful specifically because it provides you with the knowledge to understand big picture, long-term dynamics that help provide you with a general framework for navigating the world.

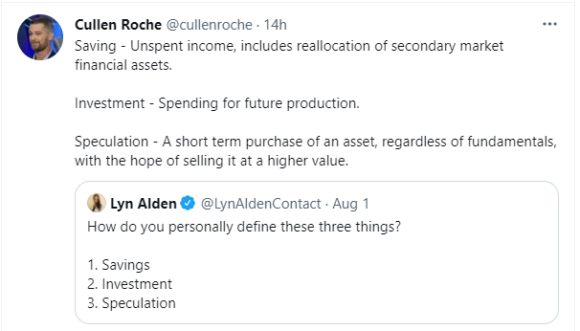

2) Words and their meanings.…One of the reasons macro frustrates people is because macroeconomists don’t always use words consistently. For instance, here’s Lyn Alden, who is very very smart, asking for definitions for three terms that aren’t always used consistently in macro. And here’s my somewhat subjective definitions:

I define “investment” in a way that is pretty different from the way most people use the term. To me, a lot of this jargon is backwards. Real investment is spending for future production. And what most people call “investing” is just reallocation of savings. While my definition is different it’s internally consistent across finance and economics. So, maybe that’s why people hate on macro – the very people who claim to understand macro cannot even communicate in a consistent language….

3) A Transitory Mess.

Here’s Jerome Powell at last week’s Fed presser trying to explain the concept of “transitory”. He doesn’t do such a great job. This ties into everything I’ve been saying in recent weeks about how this is a really bad term. Your average person thinks “transitory” means that prices will return to where they once were while Powell means that the rate of change will decline over time. It’s a pretty simple concept, but is somewhat difficult to grasp if you’re not familiar with economics and some basic statistics.

Anyhow, I did an interview last week on TD Ameritrade Network where we touched on this topic and more. I hope that clears some things up. If you don’t have time to watch it, basically, “transitory” means that prices will remain higher than they were before, but the rate at which they increase will slow. See, wasn’t that easy to understand?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.