Here are some things I think I am thinking about:

Is the Housing Market a Bubble (Again)?

I’m starting to see a lot of chatter about a housing bubble 2.0. So I went on Twitter and asked people what they thought. There were tons of smart responses if you want to review them. Ben Carlson also wrote a nice piece about the state of the housing market. I think Ben gets the big picture right. Basically, this isn’t that much like 2006 because:

- The buyers are mostly high creditworthy wealthy people.

- There hasn’t been a big building boom. In fact, supply is tight.

There’s a lot more to the story, but that’s the basic gist of what’s going on.

I’d only add that the current price boom seems to be more about COVID than anything else. In other words, I think that future demand has been pulled into the present because of COVID. So, as things normalize we might see some giveback, but I’d be surprised if prices fell much past the trendline trajectory of prices from 2012-2020. In other other words, the torrid pace of appreciation is unsustainable, but that doesn’t mean the same downside risks are present that existed in 2006.

If you held a gun to my head I’d bet that home prices ease up some in the coming years and rents actually rise a bunch. I’ve noted in recent weeks that the buy to rent ratio is fast approaching its 2006 levels, but this can correct in 3 ways. House prices crash. Rents surge. Or a bit of both. I’d guess that we’re gonna get a bit of both with much more emphasis on the rents surging piece.

Passive Investing is Wrecking the World (Again).

Every few years we get one of these articles about how passive investing is gonna wreck the world. I’ve written A LOT about indexing myths. So my head explodes a little bit every time this narrative keeps popping up. Regulars know that I am hyper focused on operational realities of the financial system. It’s pretty much my whole focus – understand things at an operational level. And discussions about “passive” investing tend to be based on somewhat basic misunderstandings. For instance, “passive investing” cannot even be a thing since everyone must deviate from the one true passive portfolio (the Global Financial Asset Portfolio). More importantly, everyone can’t be a passive (I should say less active) investor because passive investing relies on active traders and market makers to make the markets that allow passive investors to be passive.

But the thing that bothered me about this specific article was that it so clearly contradicted itself. The author starts by arguing that passive investing is problematic because a few big firms control the indexes and there’s nobody behind the scenes setting prices (which is wrong because passive needs active market makers and traders to work in the first place). But then it ends by saying that passive could be bad because 12 firms control US stocks and share voting rights and that these firms aren’t very active in voting. Well, which is it? Are they too powerful or are they not exercising that power? More importantly, who cares if they do own the voting rights and don’t act on them. After all, that is perfectly consistent with the concept of passive investing since passive investors don’t believe in intervening in corporate affairs to try to “beat the market”. Passive investors would rather let corporations be corporations and take whatever return they generate along the way.

Anyhow, I have a feeling I’ll spend most of the rest of my life discussing the same 5-10 financial myths so thank you for suffering through this with me.

So. Many. Bad. Hyperinflation. Narratives.

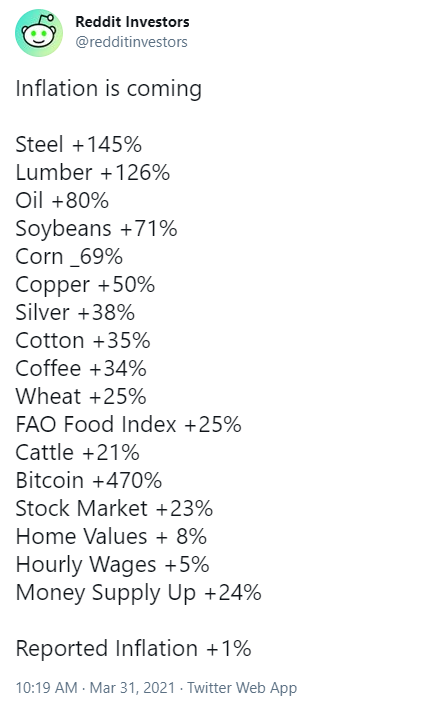

There are lots of great reasons to be optimistic about cryptocurrencies. I won’t ever pretend to know which specific cryptocurrencies will perform well, but as a whole they’re one of the most interesting things growing in finance right now. But one of the worst arguments I consistently see from Bitcoin Maximalists is this idea that hyperinflation is right around the corner. Crypto could very well serve as a great inflation hedge. In fact, I’d expect it to perform very well during a high inflation. But a lot of the current narratives about inflation seem to be based on very poor understandings of inflation dynamics. For instance, there was a data set (at right) going around Reddit that a bunch of crypto people were pumping:

Okay, so, bunch of issues here:

- These are mostly producer prices, not consumer prices. It’s not uncommon to see large swings in PPI that doesn’t materialize into CPI. In fact, this happened from 2001-2008 during the big run up in oil and commodity prices and the producer prices didn’t get passed on in large part because aggregate demand was weak and the huge price surge contributed to a price crash. As the old economic saying goes, sometimes the solution to high prices is high prices. In any case, the BLS actually talked about this in some detail back in 2012. It’s an interesting piece if you want to check it out.

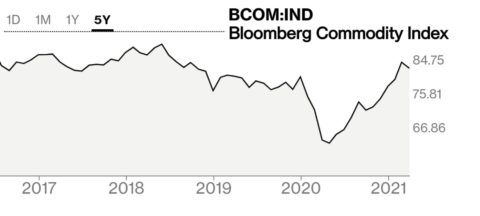

- Further, there’s some cherry picking going on here. The data picks the bottom of the price trough in many of these commodities to make it look like there’s been huge changes. But if you look at any 5 year chart (below) in the same commodities you’ll notice that prices are up only modestly. And this is important to understand because producers don’t make all of their products all at once. It’s a rolling process. So yes, some of the products were made in 2020 and some are being made as we speak. They’re incurring relative price increases across a rolling period. Some of those periods were relative price declines. The main point is, even if lumber prices are up 126% year over year, it’s clear that aggregate commodity prices aren’t up nearly as much as you might think when looking at longer time horizons.

Now, I am not saying that there’s no inflation. I’ve gone on a million podcasts in the last year saying 3-4% core inflation is coming. So yeah, could 2, 3, 4% inflation be coming? Of course. I’d be shocked if we didn’t get at least 2.5% during the Summer. But we don’t need to lose our minds and start talking about hyperinflation just because we really like Bitcoin.

That’s all I got for now. I hope everyone is staying safe and getting vaxxed. It feels like we might have a normal Summer after a pretty hellish year so here’s to hoping things don’t all come crashing down on us.

NB – On a happier note, here’s my daughter trying to eat. Every time you get frustrated by being bad at something just remember that kids are this bad at eating and no matter how bad you are at something you’ll never be this bad at that thing.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.