Here are some things I think I am thinking about.

1) Government spending staved off a much worse scenario. The inflation surge is sparking some heated discussions on the economy and the net benefit of the COVID stimulus. On the one hand, many things look great. On the other hand, inflation is hurting a lot of people more than this headline data makes it seem.

My basic view is that the stimulus was worth it on the whole. I was very vocal about the risk of high inflation through all of 2020 and 2021, but in my opinion it was a risk that we should have been willing to take given that the counterfactual was an economic crisis combined with a health crisis. Joe Weisenthal of Bloomberg has repeatedly pointed out that high inflation is a far better outcome than depression and mass unemployment. He’s not wrong. But the more data we get the more the inflation side of the debate appears to worsen. And even though I fully expected inflation there’s some uncomfortable upside in my forecasts (see below).

Think of it like this – the US economy was at risk of starvation in 2020. And we force fed it with the equivalent of fast food for 2 years. And so now the economy is obese. Are we better off? Yeah, I guess so. But we’re still obese, which isn’t exactly a great thing.

Does that mean it was all worth it? Yes. But….

2) Many of the spending programs went on too long. It’s starting to look like the third stimulus package was a mistake since we’d already done so much and it was looking like the virus was either endemic or behind us. We were pretty chubby by Q1 2021 and we just kept going back to the trough. But I also understand the argument for erring on the cautious side since we were worried the next wave of COVID might famish us again. In retrospect I wish I’d been more vocally against this because it’s starting to look like this was a pretty bad idea.

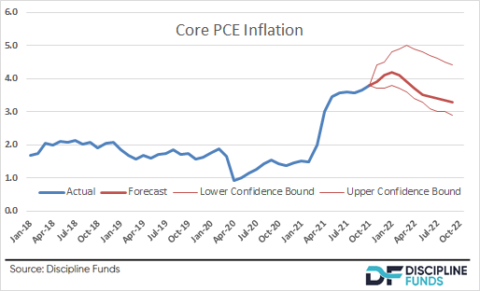

My updated estimate is that core PCE inflation is going to remain above 4% well into 2022. These are big numbers and they’re at the high end of my previous projections. So, even though I had the direction and magnitude mostly right these numbers make me pretty uncomfortable.

And yes, it’s now becoming clear that most of this is from the demand side and not just a supply side issue like many believed.¹

The good news is that there is a high probability of relief by next summer. A lot of that is just a statistical reality in that the year over year comparisons are more favorable (for lower inflation) by the time June rolls around. But we’re in for 3-6 more months of pretty bad inflation data. The worst part is there’s more upside risk than downside in the short-term because house prices are so sticky and rents lag. So, outside of a collapse in commodity prices and auto prices the likelihood of a quick decline is pretty low.

The good news is that I still think the hyperinflation predictions are totally bogus, but 6% headline CPI is not good.

3) Yes, people are going to be much more skeptical of govt spending in the future. I don’t want to be too political about this, but it’s hard to avoid. My guess is that this is going to dramatically change the narrative on government spending going forward. If headline CPI is 6% next April then the mid-term elections could be a bloodbath. Political sentiment around Democratic policies will be in the toilet.

Maybe this is a good thing in the long-run? It was starting to feel like a lot of people thought low rates and low inflation meant that fiscal policy was a free lunch. The evidence is starting to show that government deficits are very much not a free lunch. So maybe a return to the modest deficits of the last 10 years isn’t such a bad thing?

¹ – I’ve seen a barrage of economic pundits gaslighting on this topic (Krugman saying it can’t be government spending because it’s global, Reich saying it’s all corporate monopoly power and Schwarz saying inflation is good for us all²). If there was one really valuable lesson from the Great Financial Crisis it was that Monetary Policy isn’t that powerful. And the COVID stimulus proved, definitively, in my mind, that fiscal policy is a huge powerful bazooka. We ran $3T+ deficits for 2 years and almost made a recession disappear completely. Why are people now denying that fiscal policy is hugely powerful? Perhaps dangerously powerful in some ways?

Schwarz saying inflation is good for us all²). If there was one really valuable lesson from the Great Financial Crisis it was that Monetary Policy isn’t that powerful. And the COVID stimulus proved, definitively, in my mind, that fiscal policy is a huge powerful bazooka. We ran $3T+ deficits for 2 years and almost made a recession disappear completely. Why are people now denying that fiscal policy is hugely powerful? Perhaps dangerously powerful in some ways?

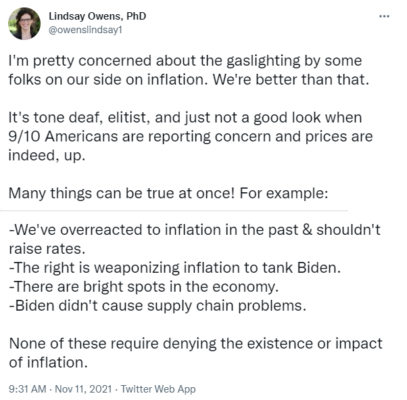

I think Lindsay Owens summarized this nicely below. Yes, yes. yes. The only thing I would add is that Republicans also passed these bills. It wasn’t one sided. And there’s nothing wrong with admitting that fiscal policy and government spending caused inflation.

² – A footnote inside a footnote. The best kind. Let’s discuss these real fast. The issues are multi-faceted, but there’s no need to downplay the fiscal impact unless you have a specific political agenda. On Krugman – we pumped $14T to the largest global consumer in the world. It’s not shocking that some of this might impact prices abroad even if they did so to a lesser extent. On Reich – yes, corporations have huge power over prices. And regular readers know that government deficits add to corporate profits. You can’t talk about corporate power during a time of huge deficits and not talk about how the deficits added to corporate pricing power. On Schwarz – the idea that inflation is good for poor people is silly. Inflation is bad for everyone, but it’s better for rich people who own the things they can control pricing power over. A study of hyperinflations in third world countries shows that high inflation isn’t just bad for poor people, it ruins their lives.

NB – This is a pretty interesting thing to think about from a market and policy perspective because, if we see inflation start to moderate by Q2 2022 then it will probably be too late to panic about inflation. It will be very interesting to see if policymakers flinch from their “transitory” position and potentially hurt H2 2022 growth.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.