1) The Fed is out of Patience. The Federal Reserve dropped the word “patience” from their most recent statement. Yes, that’s right – we now parse every line of the statement so closely that the removal of a single word is big news. The bottom line is that the Fed has set the table for a rate increase, but they’ve left the timing of that fairly wide open.

The markets rallied across the board on the news because many people were expecting a June rate increase and possibly some guidance on that today. They didn’t get any hint of a June hike so the Fed looks more dovish than some might have expected. In other words, I would expect the earliest rate hike to come in the back half of the year.

Here’s the full statement if you’re into lengthy, boring and repetitive reading. Or maybe you’ll save it for bed time. Probably very good sleep prep.

2) March Behavioral Madness. It’s that time of year again – March Madness. Millions of people will fill out their NCAA brackets trying to project the winner of the college basketball championships. But that’s not the entertaining part for me. Yes, yes, I will fill out a bracket so I can remind myself how little I know about college basketball and how biased I am towards the Georgetown Hoyas, but the best part for me is looking at how people inevitably analyze the various teams. It would make an amazing case study in how biased we all are when analyzing things we don’t really understand that well.

For example, let’s stick to how bad the Hoyas have been in the past 10 years. The Hoyas have been knocked out by a 10+ seed in the tournament in 2008, 2010, 2011, 2012, and 2013. So, we’ve seen lots of commentary about how the Hoyas tend to choke when seeded high. But this has to be total nonsense. After all, no one on the 2008, 2010 or 2011 team is even playing for the Hoyas! This is reminiscent of the Gambler’s Fallacy. This is the tendency to take past events and apply some connection to future events when the two events are totally independent of one another. The same is true for the NCAA Tournament. It doesn’t matter what a team’s historical record is in the tournament because the teams who compiled those records were made up of totally different players in totally different environments. This doesn’t stop the historical comparisons from constantly being rolled out.

The reality is that we’re all biased. And we let these sorts of nonsensical “facts” cloud our better judgment day in and day out. It’s better to treat each environment independent of past history. Yes, it’s fine to understand the historical record, but it shouldn’t be the dominant variable forming your conclusions. We all have to make forecasts. We all have to consider that it’s always different this time. Your biases will pull you in the opposite direction, but the ability to fight that urge will save you a lot of time and money.

That said, the Hoyas will still lose early. Sorry fellow alums….Utah has our number this year.

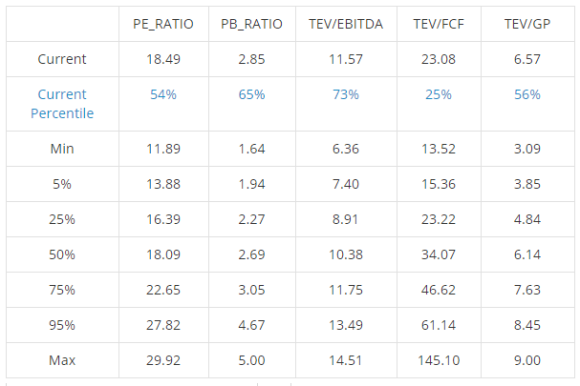

3) Beware The Macro Value Trap. Here’s a good post from the guys over at Alpha Architect on the current state of valuations. This chart is particularly illuminating:

I’ve talked about the dangers of the macro value trap before. In essence, you have to be careful relying on macro value indicators because they can tell you almost anything you want them to depending on which one you decide to focus on. Just look at the range of outcomes above. You could argue that the market is undervalued or overvalued depending on your bias. And that’s how a lot of people get themselves in trouble.

I personally don’t find value metrics to be all that useful when considering broad asset classes (except maybe in extreme cases). And the reason why is because valuations are so dynamic. According to CAPE shiller the US stock market has been overvalued for almost 20 years. How many people have been scared away from the stock market over this time because of people screaming about high valuations? Valuations are always a favorite tool of the doom and gloomers. They love to separate emotional people from their savings by scaring them into believing that the next crash is around the corner just because they cherry picked some valuation metric that rhymes with the fear they need to sell to keep you reading this nonsense.

In my view, it’s better not to try to apply a micro concept (value investing) to the macro perspective. So just say no to macro valuation metrics.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.