So much going on, so little time to write about it all. Let’s get to it:

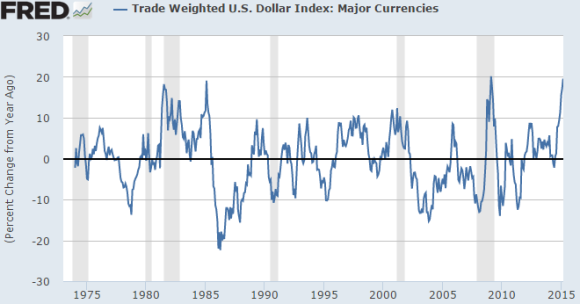

1) The Dollar is ripping higher at a historic rate. I posted this chart on Twitter the other day showing just how unusual it is for the US Dollar to appreciate at its current rate. This is the year over year rate of change in the USD vs major currencies. As you can see, this happens roughly once every 15 years. Pretty unusual stuff:

Forex markets are basically assuming a one way sort of trade in the dollar primarily due to monetary policy changes. The ECB and BOJ are both easing while the Fed is talking about tightening. There’s also a bit of relative economic strength being priced in here, but the move is clearly a repricing based on monetary policy for the most part given the timing of the moves in relation to the actual policy changes.

These sorts of adjustments can have big near-term impacts due to the magnitude of the change. We’re likely to see a hit to US GDP (probably not more than a few tenths of a percentage point) as a result of the rising dollar, but the real damage is being done abroad. Neil Irwin has a nice piece in the Times today discussing the ripple effect of the dollar in emerging markets where foreign companies borrowed in USD at low rates and are now sitting on devalued currencies and high debt loads. It’s always kind of humorous to me how these moves seem to shock the financial markets. That is, we can go years assuming that prices are “stable” only to suddenly undergo a massive repricing. One might even think the markets aren’t so good at digesting information based on how rapid and emotional some of these moves tend to be….

2) An infinite regress of dumb. Brad Delong has a wonderful piece on Medium about the silly idea of market efficiency. He discusses a speech in which Richard Thaler, the behavioralist, discusses the beauty contest. In this game the audience picks a number from 0-100 and the winner is the person who is closest to 2/3rds of the average. So, most people go, “50 will be the average so I’ll pick 33”. But the really smart people do a bit of second level thinking and they pick 22 thinking that most people will pick 33. And the really, really smart people pick 15 because, well, they’re way overthinking things. So on and so forth. If everyone was thinking “efficiently” you regress to…ZERO. Thaler calls this an infinite regress of dumb. Bingo.

Grossman and Stiglitz wrote a famous paper back in 1492 debunking the idea of informationally efficient markets, but that didn’t stop Eugene Fama and his merry band of anti government economists from making the idea of “efficient markets” one of the most prominent in all of finance. G & S basically said that the markets couldn’t be efficient because if they were then you get this sort of infinite regress of dumb. Second level thinking turns into third level thinking which turns into fourth level thinking…The basic idea is that even if all information is interpreted in the price of financial assets the market participants end up in a sort of irrational revolving door. Personally, I don’t even think most people engage in anything close to second level thinking in the financial markets. In essence, you have to assume the markets are actually “smart” before you can get your infinite regress of dumb. More likely, the markets are always pretty poorly informed and so we’re all just sort of guessing our way through things in what never really resembles anything all that efficient.

Anyway, I’ve made my peace on the efficient market theory. I basically think it’s a form of propaganda that was constructed to make an economic theory (Monetarism) appear consistent with a financial theory. And you ended up with the idea that markets are so good at pricing in information that it would be silly to allow anyone to intervene in a discretionary manner. So you got all sorts of strawman attacks on “active” investors and any form of government intervention in the markets. It’s seamless! Except then Monetarism totally collapsed on its face and we’re slowly realizing that Modern Portfolio Theory and EMH have more holes in them than many might have previously thought. Politics in economics, as usual, has set us back many decades.

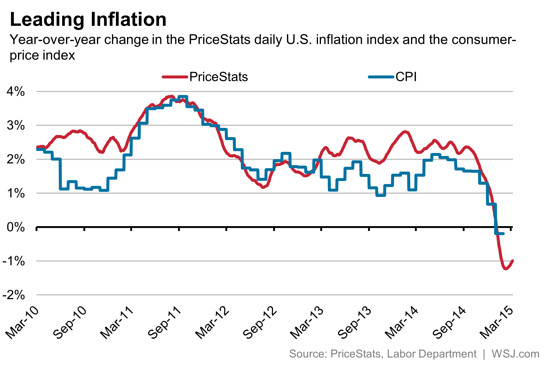

3. Getting ahead of inflation. This was a very interesting piece in the WSJ on inflation and the Billion Prices Project. We can again jump on the inefficient market bandwagon here and talk about how markets really don’t seem to be all that forward looking. That is, if you start to think ahead then there’s a very real chance that inflation will start to look modestly high because of low year over year comps. So, think about 12 months out from now and consider a world in which oil prices have rebounded even modestly from $43 to, say $50. Well, all of the sudden the energy complex starts to look like it’s rising at a 16% year over year rate. You can basically do this across the entire commodity complex and do the year over year comps. Inflation could actually start to look moderately high as a result.

The Billion Prices Project puts this thinking in better visual form:

It begs the question – yes, deflation looks like the obvious trade right now. But what if there’s an outside chance that that red line shoots higher in the coming 18 months solely due to easy comps? Or worse, what if inflation is actually higher than some expect? Then what? Will the inflationistas begin to look like their day in the sun is coming? I don’t think I’d bet the farm on it, but I am not as confident today betting against the Peter Schiffs of the world as I have been over the last 5 years….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.